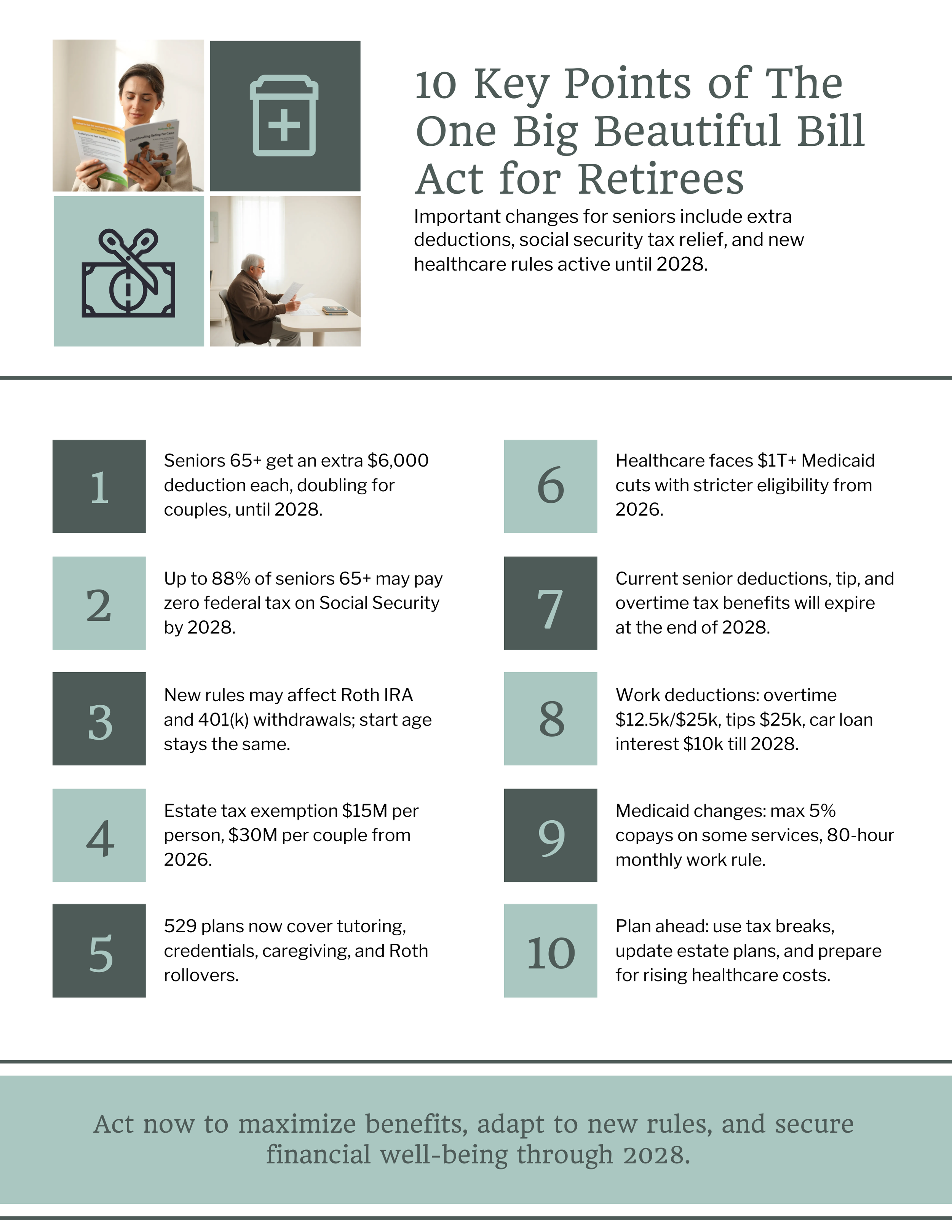

10 Things Retirees Need to Know About the One Big Beautiful Bill Act

The One Big Beautiful Bill Act (OBBBA) is now law. Signed on July 4, 2025, it promises tax breaks, new deductions, and sweeping changes to retirement, healthcare, and estate planning rules. For retirees, the bill is a mix of opportunities and potential pitfalls. Some changes could lower your taxes in the short term, while others might require you to rethink long-term strategies.

Here are ten key points you need to know.

1. A New Senior Deduction Can Cut Your Social Security Taxes

Starting with 2025 tax returns, individuals aged 65 and older can claim an extra $6,000 deduction. Married couples where both spouses qualify can claim $12,000. This deduction phases out for individuals earning over $75,000 and couples earning over $150,000. It ends after 2028.

The White House says this will mean 88% of seniors will pay no federal tax on their Social Security benefits. Independent experts say the real number is much lower, but for many, it will still mean a smaller tax bill in the near term.

Get your free tax‑saving plan for retirement

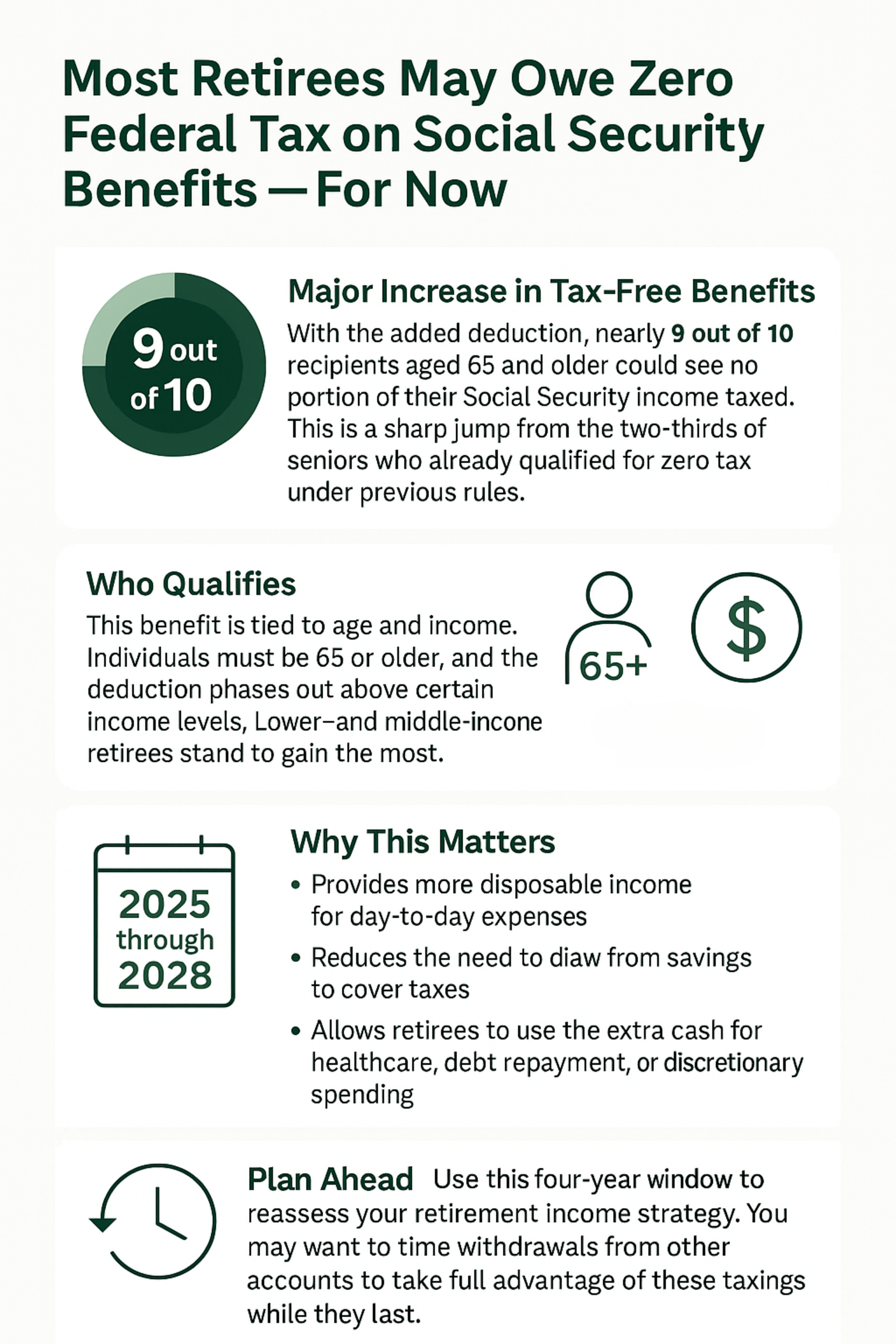

2. Most Retirees May Owe Zero Federal Tax on Social Security Benefits For Now

With the new deduction, almost nine in ten Social Security recipients aged 65 and older could see no part of their benefits federally taxed. This is a big jump from the current two-thirds who enjoy that status. But the change is temporary, and the rules return to current law after 2028 unless extended.

3. Required Minimum Distributions Could Get More Complicated

OBBBA does not raise the age for required minimum distributions beyond the 73-to-75 schedule set by SECURE 2.0. Instead, it orders a study on imposing RMDs on Roth IRAs and large 401(k) balances. That raises uncertainty for retirees who use Roth accounts to grow funds tax-free. Planners may need to adjust withdrawal strategies if new RMD rules emerge.

4. The Estate Tax Exemption Will Rise Sharply

From 2026, the gift and estate tax exemption will increase to $15 million per person, up from $13.99 million in 2025. Married couples can shield up to $30 million. This higher limit is permanent under current law, but future lawmakers could reduce it. For retirees thinking about leaving a large legacy, 2025 and 2026 offer a planning window.

Get your free tax‑saving plan for retirement

5. 529 Plans Gain More Flexibility

Qualified withdrawals from 529 plans now cover K–12 tutoring, professional credentials, and caregiving certifications. The existing rule allowing rollovers to Roth IRAs remains. These changes make 529s a more flexible option for parents and grandparents to help with a child’s education.

6. Healthcare Cuts Could Increase Your Costs

The bill reduces Medicaid funding by more than $1 trillion and trims Affordable Care Act subsidies. While Medicare remains untouched, seniors relying on Medicaid for long-term care may face stricter eligibility rules. By 2026, states must run new asset verification checks. Retirees with limited savings but significant home equity could be affected.

7. Many Tax Breaks Expire in 2028

Several headline benefits including the senior deduction, tip income deduction, and overtime deduction will vanish after December 31, 2028. If you want to take full advantage, you may need to accelerate income planning and withdrawals before the expiration date.

8. New Tax Breaks for Overtime, Tips, and Car Loan Interest — Even for Retirees Who Work

If you work part-time in retirement, you may benefit from three new deductions:

Overtime pay deduction: Up to $12,500 for singles and $25,000 for couples, if your income is within limits.

Tip income deduction: Up to $25,000, depending on occupation and reporting.

Car loan interest deduction: Up to $10,000 for eligible vehicles assembled in the United States.

These apply from 2025 through 2028 and are available to taxpayers who do not itemize.

9. Medicaid Work and Copay Rules Are Changing

By the end of 2026, Medicaid will set maximum copayments of 5% of income for non-primary care services. States will also require most non-disabled adults to work at least 80 hours a month to keep Medicaid coverage. While these requirements target the general population, they could indirectly affect retirees living with younger household members who rely on Medicaid.

Get your free tax‑saving plan for retirement

10. Planning Ahead Matters More Than Ever

The OBBBA offers a mix of tax relief and reduced safety net benefits. The senior deduction, higher estate tax exemption, and expanded 529 uses create immediate opportunities. But looming healthcare cuts, possible RMD changes, and expiring provisions make it risky to assume the benefits will last.

Retirees should:

Review tax projections for 2025–2028

Consider the tax effect of withdrawals before provisions expire

Update estate and beneficiary plans before 2026

Factor possible healthcare cost increases into budgets

Stay informed about future legislation that could alter these rules again

Bottom Line

The One Big Beautiful Bill Act delivers short-term gains but leaves plenty of long-term questions. For retirees, the key is to act early, use the temporary benefits wisely, and prepare for changes that could affect income, healthcare, and legacy plans. Work closely with a financial advisor to make the most of the opportunities while protecting yourself from the risks.

Reference

Investopedia. (2025, July 9). The Big Beautiful Bill and Retirees. Retrieved from https://www.investopedia.com/the-big-beautiful-bill-and-retirees-11766799

Internal Revenue Service. (2025, July 14). One Big Beautiful Bill Act: Tax deductions for working Americans and seniors. Retrieved from https://www.irs.gov/newsroom/one-big-beautiful-bill-act-tax-deductions-for-working-americans-and-seniors

Internal Revenue Service. (2025, July 14). One Big Beautiful Bill Act of 2025 provisions. Retrieved from https://www.irs.gov/newsroom/one-big-beautiful-bill-act-of-2025-provisions

Raisinghani, V. (2025, August 10). Trump says 88% of US retirees will now pay zero taxes on Social Security — but can the ‘big beautiful bill’ hurt you? Retrieved from https://finance.yahoo.com/news/trump-says-88-us-retirees-100000864.html