12 Things You Need to Know to Build a Strong Estate Plan

Estate planning is not just about writing a will. It is about protecting your family, reducing legal complications, and making sure your wishes are honored. If you own property, have children, or hold accounts in your name, you already have an estate. The question is whether you have a plan that makes sense for your situation.

A strong estate plan gives you clarity and control. It covers who manages your money and healthcare if you cannot, who inherits your assets, and how taxes, debts, and final expenses will be handled. Without it, the courts step in, often creating stress and unnecessary costs for the people you care about most.

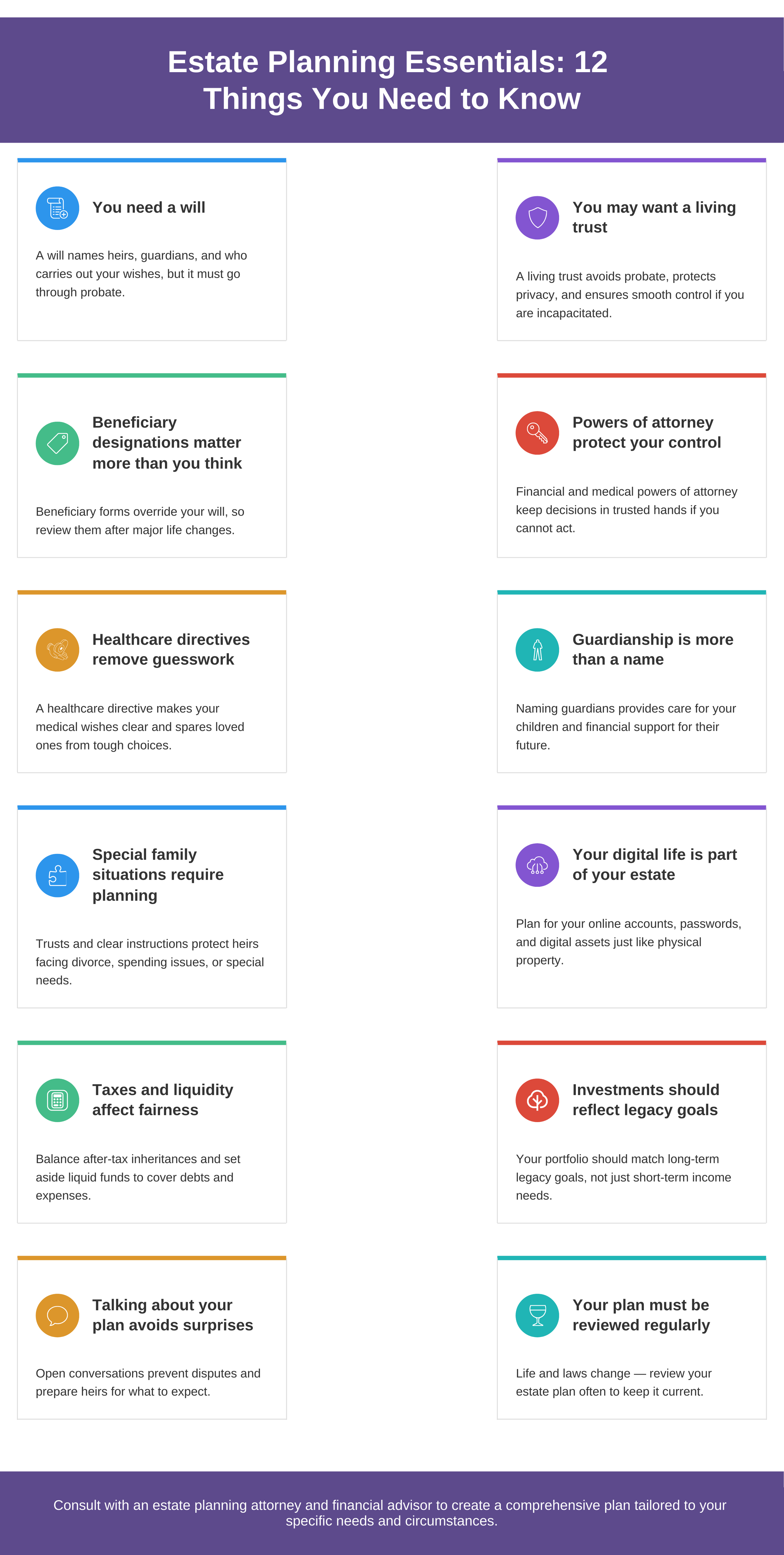

This guide highlights twelve important things you need to know when building a strong estate plan, followed by a checklist you can use to make sure nothing gets overlooked.

Get your free tax‑saving plan for retirement

1. You need a will

A will is the foundation of most estate plans. It states who inherits your assets and who carries out your wishes. You can use it to name guardians for minor children and to give directions about personal items. Keep in mind that a will must pass through probate, which can cause delays and fees, but it remains the basic document every plan needs.

2. You may want a living trust

A revocable living trust lets you move assets out of your name while keeping control during your lifetime. It avoids probate, keeps matters private, and allows a trustee to step in if you become incapacitated. Pairing a trust with a pour over will ensures any assets you forget to transfer still follow your plan.

Estate Planning Infographics

3. Beneficiary designations matter more than you think

Retirement accounts, life insurance, and payable on death accounts all pass directly to the people you list as beneficiaries, regardless of what your will says. That makes it critical to review these designations after major life changes such as marriage, divorce, or the birth of a child.

4. Powers of attorney protect your control

A durable financial power of attorney allows someone you trust to handle money decisions if you cannot. A medical power of attorney appoints someone to make healthcare choices on your behalf. Without these, a court may appoint a guardian, which removes your control.

5. Healthcare directives remove guesswork

A healthcare directive (sometimes called a living will) lays out your medical preferences, including end-of-life care and use of life support. It removes uncertainty for your family and provides clear instructions to doctors.

6. Guardianship is more than a name

If you have children, your plan should name legal and financial guardians. Think through the time and costs involved and consider financial support through insurance or a trust. Communicate your values about education and money so the guardian can make choices in line with your wishes.

7. Special family situations require planning

Some heirs may need extra protection. If an heir faces divorce or spending problems, trust provisions can safeguard their inheritance. A special needs trust protects benefits for a child or dependent with disabilities. Decide how assets should pass if a beneficiary dies before you by including clear instructions.

8. Your digital life is part of your estate

Online banking, email, cloud storage, and social media accounts are now part of modern estates. Keep a record of accounts and passwords in a secure manager, and include instructions for how they should be handled. Many platforms let you assign a digital legacy contact.

Get your free tax‑saving plan for retirement

9. Taxes and liquidity affect fairness

Assets are taxed differently. Retirement accounts may create taxable income for heirs, while taxable accounts may receive a step-up in basis. Review your plan to make sure heirs receive fair after-tax amounts. Also plan for liquid funds or insurance to cover debts, taxes, and funeral costs so heirs do not have to sell property quickly.

10. Investments should reflect legacy goals

Estate planning is not only about documents; it is also about how your money is invested. If your goal is to provide for heirs or a cause for decades, a long-term strategy with growth assets may make more sense than a short-term income focus.

11. Talking about your plan avoids surprises

Silence often leads to conflict. Share your values early with children and add details as they mature. With adult heirs, explain your reasoning, especially if distributions are unequal or if charitable gifts are included. Introduce them to your advisor and attorney so they know who to contact later.

12. Your plan must be reviewed regularly

Estate planning is not a one-time task. Update documents after marriage, divorce, births, deaths, or a move to a new state. Revisit your plan every few years to check beneficiary forms, titles, trustees, and guardians. Laws also change, so review with your attorney to stay current.

Checklist: What Issues Should I Consider When Crafting My Estate Plan

General issues

Revocable trust considered for probate avoidance and control, with a pour over will in place.

Will drafted and stored, with probate implications understood.

Guardians named for minor children, with compensation and support planned.

Living will completed with clear medical preferences.

Durable powers of attorney for both financial and medical decisions in place.

Successors or alternates named for executor, trustee, or guardian roles.

Plan to cover debts, funeral, and legal expenses through liquid funds or insurance.

Asset issues

Strategy for illiquid assets such as home or land, with options to keep, sell, or buy out.

Allocation of qualified and non qualified accounts reviewed for after tax fairness.

Digital assets and passwords documented in a secure manager.

Personal property such as jewelry or heirlooms listed in a letter of instruction.

Probate and transfer

Joint ownership reviewed for fit with overall plan, such as joint tenants or tenants in common.

Beneficiary forms for retirement accounts and insurance reviewed and updated.

Transfer on death or payable on death accounts used where helpful.

Other issues

Charitable giving plan documented, with options for charitable remainder trusts considered.

Federal and state estate tax exposure reviewed, with gifting strategies or irrevocable trusts considered.

Special needs of heirs addressed with a special needs trust if required.

State specific inheritance or probate laws checked with legal counsel.

How One Advisory Partners Helps You Build a Strong Estate Plan

Estate planning can feel complex if you try to manage it alone. One Advisory Partners works with you to turn uncertainty into a clear plan. We help you:

Review and update your will, trust, and beneficiary designations

Coordinate with attorneys and tax professionals for a complete strategy

Align your investments with long-term legacy goals

Plan for taxes, liquidity, and charitable giving in the most efficient way

Keep your plan up to date as your life and the law change

As a hybrid-fee fiduciary firm, our advice is objective, transparent, and 100% aligned with your goals, not a product agenda. Our role is to guide you through every decision so your estate plan reflects your wishes, protects your family, and gives you peace of mind.

Get your free tax‑saving plan for retirement

Bottom line

Building a strong estate plan is about control, clarity, and care for the people and causes you value. Putting the right documents in place, aligning your investments with your legacy goals, and talking openly with your family ensures your plan works as intended. When done well, an estate plan provides peace of mind now and relieves stress later.

FAQs About Estate Planning

1. What is the difference between a will and a trust?

A will names heirs and goes through probate, while a trust takes effect during life, avoids probate, and keeps matters private.

2. Do I need an estate plan if I am not wealthy?

Yes. If you own property, have children, or even a bank account, you already have an estate — and you need a plan.

3. How often should I review my estate plan?

Review your plan every few years, or after major events like marriage, divorce, births, deaths, or moving to a new state.

4. What happens if I do not have an estate plan?

Without a plan, state laws and courts decide who inherits your assets and who makes decisions if you cannot.

5. What is a power of attorney and why is it important?

A power of attorney lets you name someone to manage money or healthcare decisions on your behalf if you are unable.

6. How do digital assets fit into estate planning?

Digital accounts like email, banking, and cloud storage should be listed with instructions for how to manage or close them.

7. Can estate planning help with taxes?

Yes. Planning can reduce estate taxes, balance after-tax inheritances, and provide liquidity to cover expenses.

Reference

Investopedia. (2025). Estate Planning. Retrieved from https://www.investopedia.com/terms/e/estateplanning.asp

Justia. (2025). The Duties of an Executor of an Estate. Retrieved from https://www.justia.com/probate/probate-administration/the-duties-of-an-executor-of-an-estate/

ACTEC. (2025). What Is Probate? Retrieved from https://www.actec.org/resource-center/video/what-is-probate/

American Bar Association. (2025). Revocable Trusts. Retrieved from https://www.americanbar.org/groups/real_property_trust_estate/resources/estate-planning/revocable-trusts/

Ohio State Bar Association. (2025). Administering an Estate Without a Will. Retrieved from https://www.ohiobar.org/public-resources/commonly-asked-law-questions-results/law-facts/law-facts-administering-an-estate-without-a-will/

American Bar Association. (2025). Introduction to Wills. Retrieved from https://www.americanbar.org/groups/real_property_trust_estate/resources/estate-planning/intro-wills/