Are Women Missing Out on a Secure Retirement?

Retirement is one of the biggest financial journeys you’ll ever take. But the reality is, the road to retirement looks very different for women. It can feel overwhelming when the advice out there often ignores women’s real experiences. Let’s cut through the confusion and give you straight talk, real facts, and actionable steps, so you can own your future with confidence.

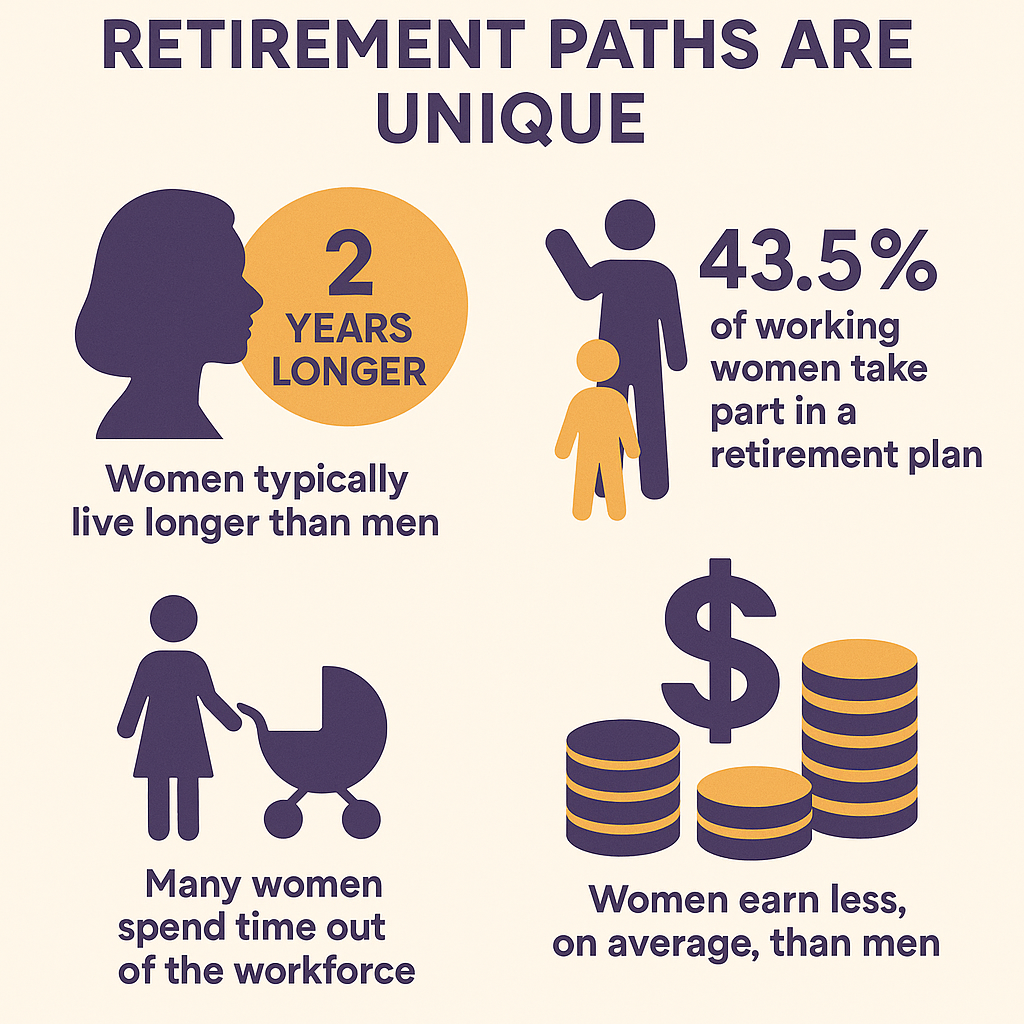

Why Women’s Retirement Paths Are Unique

Why Women’s Retirement Paths Are Unique

Women’s lives and work patterns are often different from men’s. Most women live longer. They live about two years longer than men if they retire at 67. This gives women a longer retirement to fund. Your savings have to last and grow even more.

But longevity isn’t the only issue. Fewer women work in jobs that offer retirement plans, and women are more likely to work part-time. Many women step away from the workforce to care for children, parents, or both. These breaks often mean fewer years worked, less access to workplace savings plans, and less money set aside for the future. For example, about 43.5 percent of working-age women participate in a retirement plan. If you’re not one of them, you’re not alone, but you can still start now.

The wage gap also takes a toll. Women, on average, earn less than men. This smaller paycheck means lower Social Security benefits and fewer employer contributions to retirement accounts down the road. Compound that with more conservative investment choices, and women’s savings can easily fall behind.

Download your free guide to mastering taxes in retirement today!

The Power of Early and Consistent Saving

It may seem like saving is something you’ll get to “later.” But the earlier you start, even with small amounts, the more your savings will grow. Time and compound interest are your best friends. Even if your job is part time or temporary, check to see if you’re eligible for a workplace retirement plan. If you are, join as soon as you can and contribute as much as possible. Many employers match a portion of your contributions. This is free money, so don’t leave it behind.

If you aren’t eligible for a plan at work, don’t worry. Anyone with earned income, or married to someone who earns income, can contribute to an IRA. If you’re self-employed, look into SEP or SIMPLE IRAs, which are specifically designed for small business owners and freelancers.

Early and Consistent Saving

Smart Steps to Strengthen Your Retirement

1. Join a Retirement Plan and Maximize Contributions

If you’re working, ask your employer about retirement plan options. If they offer a 401(k) plan, enroll and contribute as much as you can. Focus on contributing up to any company match. The most common employer match is 50 percent of your contribution up to 6 percent of your salary. That’s a significant boost to your savings.

2. Understand Vesting Rules

Vesting means you’ve worked long enough to keep your employer’s contributions, even if you leave the job. Too many women leave or change jobs just before they become vested and lose out on benefits. Ask your HR department or retirement plan administrator how long you need to work to be fully vested.

3. Keep Track of Your Plan Documents

Always keep the summary plan description (SPD) and any updates from your retirement plan. These documents explain your benefits, how they’re calculated, and what happens if you retire early. If you can’t find your copy, request another from your employer or plan administrator. Keep records from all your jobs. You may have retirement money waiting for you from past employers.

4. Know What Happens When You Change Jobs

If you’re vested, you don’t lose your benefits when you leave. Some employers let you take a lump sum, but this could trigger taxes and penalties. The best move is to roll over your savings directly into another retirement plan or an IRA within 60 days to avoid a big tax hit. Always ask the plan to send the money directly to your new account. If you receive the funds directly, 20 percent will be withheld for taxes, and you’ll have to wait for a refund.

5. Save for Retirement Even Without a Work Plan

No workplace plan? No problem. Open an IRA, Roth IRA, or if you’re self-employed, a SEP or SIMPLE IRA. The tax advantages and growth potential are significant. Remember, if you’re married and file jointly, you may be able to contribute to a spousal IRA even if you have no personal income.

6. Monitor Your Social Security and Plan for Family Changes

Track your earnings and Social Security credits at ssa.gov. Social Security is a big part of most women’s retirement income. You may be eligible for benefits through your own work or your spouse’s. Special rules apply if you are divorced, widowed, or if you both have paid into Social Security.

If you’re divorced, you may have rights to part of your spouse’s retirement through a Qualified Domestic Relations Order (QDRO). Survivor benefits are also available if your spouse dies, especially if you’re named as a beneficiary on a defined benefit plan. Always check with the plan administrator and keep all documents.

7. Invest Wisely

Studies show women often invest more conservatively than men. While it’s important to be careful, learn about your investment options so your money can work harder for you. Don’t be afraid to get advice and make adjustments as your confidence grows.

8. Build an Emergency Fund

Aim to save three to six months of living expenses in an interest-earning account. Life happens, and having a cash cushion protects your retirement accounts from being tapped in a crisis.

9. Take Advantage of Resources

There’s no shortage of free help. The Employee Benefits Security Administration (EBSA) has excellent guides like “Savings Fitness: A Guide to Your Money and Your Financial Future.” Visit mymoney.gov, ssa.gov, and Investor.gov for information tailored to women’s needs. Ask for “What Every Woman Should Know” from Social Security, and download guides from the Pension Benefit Guaranty Corporation and other organizations.

Download your free guide to mastering taxes in retirement today!

Bottom Line

No matter where you are on your journey, whether you are starting your first job, returning to work after a break, or nearing retirement, it’s never too late to improve your financial outlook. The key is to be proactive, seek advice, and make a plan that works for your life.

Take stock of your current savings and benefits. Learn about your options. Don’t let the system or your circumstances stop you from pursuing a secure, comfortable future. Ask questions. Seek out mentors and professionals. Use the tools and resources available.

Most importantly: believe in your power to shape your retirement. Women have unique challenges, but you also have unique strengths. By saving consistently, staying informed, and advocating for yourself, you are setting the foundation for a better, brighter retirement.

Reference

Investopedia. (2025, March 6). Building Better Retirement Strategies for Women. Retrieved from https://www.investopedia.com/building-better-retirement-strategies-for-women-8367558

U.S. Bank. (2024). Women, Wealth & Retirement: Financial Planning for Women. Retrieved from https://www.usbank.com/wealth-management/financial-perspectives/women-and-money/women-wealth-retirement-financial-planning.html

U.S. Department of Labor. (2023, September). Women and Retirement Savings. Retrieved from https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/women-and-retirement-savings.pdf

U.S. Department of Labor, Employee Benefits Security Administration. (2024). About EBSA. Retrieved from https://www.dol.gov/agencies/ebsa

U.S. Department of Labor, Employee Benefits Security Administration. (2023). Savings Fitness: A Guide to Your Money and Your Financial Future. Retrieved from https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/retirement-savings-fitness-guide.pdf

MyMoney.gov. (2024). Financial Tools and Resources. Retrieved from https://www.mymoney.gov/

U.S. Securities and Exchange Commission. (2024). Investor.gov. Retrieved from https://www.investor.gov/

Social Security Administration. (2023). What Every Woman Should Know (Publication No. EN-05-10127). Retrieved from https://www.ssa.gov/pubs/EN-05-10127.pdf

Pension Benefit Guaranty Corporation. (2024). About PBGC. Retrieved from https://www.pbgc.gov/