Are Women Paying the Price for Divorce?

Divorce is more than an emotional event. For many women in the United States, it is a financial shock that can reshape your life for years. Here’s what you need to know about the real numbers and risks for women who divorce in America.

The Drop in Income Is Real

Most people see their income drop after divorce, but women experience a steeper decline.

On average, women can expect almost a 30 percent drop in standard of living following divorce. For men, there is often a ten percent increase.

Why is the gap so wide? The reasons are clear:

Career breaks for raising children lower long-term earnings.

Women are more likely to be the main caregivers, limiting job options and earnings.

Many women receive less than full child support. Three out of four divorced mothers do not get the full payments owed.

Many Women Cannot Handle a Financial Emergency

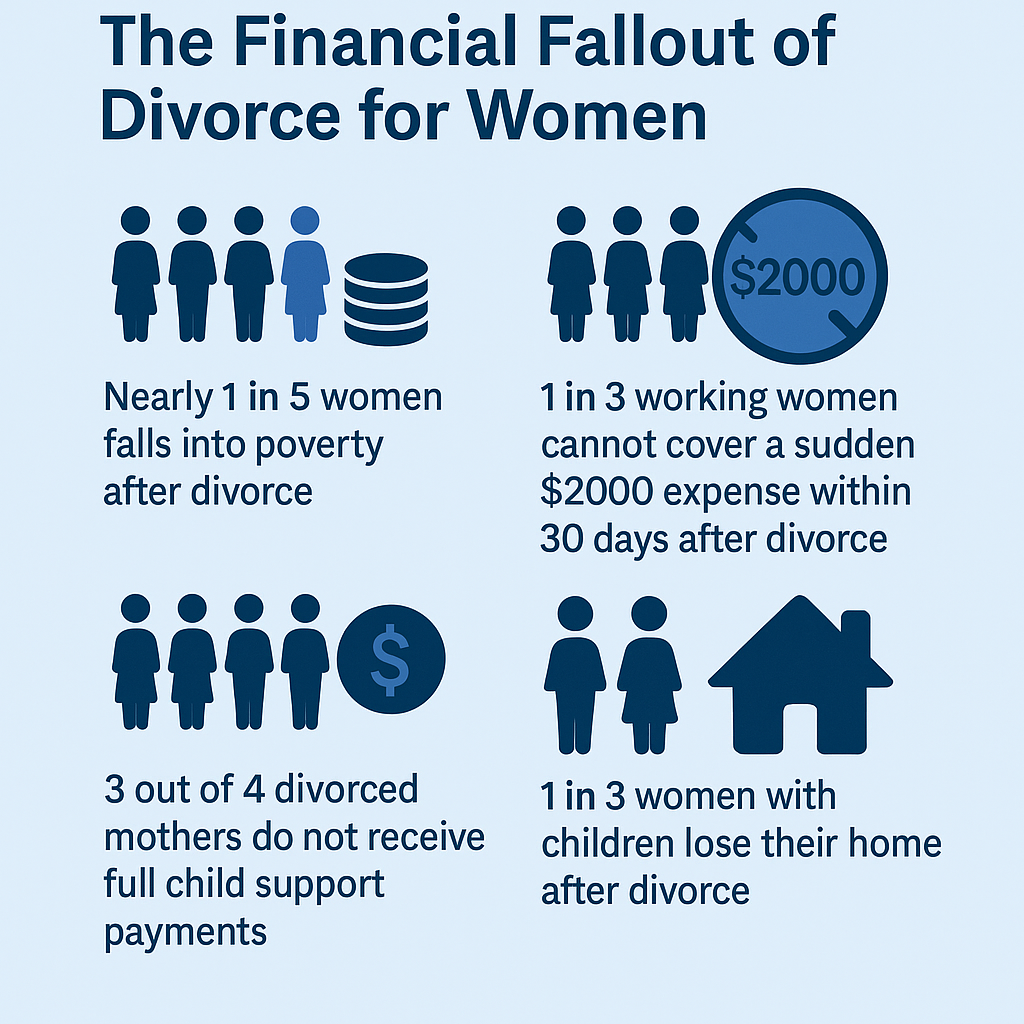

About one in three working women cannot cover a sudden two thousand dollar expense within thirty days after divorce. The same assets that once supported one home must now stretch to support two, and bills can add up quickly. Nearly one in five women falls into poverty after divorce.

Financial Fallout of Divorce for Women

The Home Is Not Always the Safe Choice

After divorce, deciding what to do with the house is one of the hardest choices. Many women want to keep the family home. Often, this is not practical. Here is why:

The equity in your home is not cash in your hand. It cannot pay bills unless you sell or refinance.

After divorce, you may be solely responsible for mortgage, taxes, and repairs.

If you cannot qualify to refinance in your own name, you risk losing the home anyway.

The law says you need a reasonable debt-to-income ratio and an acceptable credit score to keep a mortgage on your own.

Be realistic about your budget. Consider all costs before agreeing to keep the house.

Download your free guide to mastering taxes in retirement today!

Asset Division: The Details Matter

Dividing assets is rarely simple. You need to:

List all assets, including retirement accounts, real estate, savings, investments, and personal property.

Understand that not all assets are equal. For example, a one hundred thousand dollar checking account is not the same as a one hundred thousand dollar IRA. The IRA will be taxed when you withdraw funds.

Pay close attention to tax consequences when splitting assets.

Pensions and Retirement Are Often Overlooked

Many women leave a spouse’s pension or retirement savings out of negotiations. Any part earned during marriage is considered a marital asset.

Your options may include taking a share of future pension benefits, offsetting with another asset, or a mix of both.

Women who leave pensions out of settlements risk serious financial challenges later, especially given women’s longer life expectancy.

The wage gap means women also get less from Social Security over time.

Liquidity Is Key

Legal fees, moving expenses, and new housing costs hit fast.

You need enough cash or liquid assets to cover short-term needs. Avoid getting locked into assets you cannot easily convert to cash.

Cars, boats, and furniture lose value. Real estate and retirement accounts can be difficult and expensive to access.

Child Support and Spousal Support Are Not Guaranteed

More than half of custodial parents in the US do not receive full child support payments.

If you are counting on support, get a legal order. You can also protect payments by negotiating for a life insurance policy that covers your former spouse’s obligation to you.

In case of a lump sum settlement or equalizing payment, discuss how to secure it legally. A support order or collateral may be needed.

Adjusting to a New Standard of Living

Divorce usually means splitting family assets and income, while the cost of supporting two separate households quickly adds up. You may need to cut expenses or accept a smaller lifestyle. Planning for this change early can help you avoid bigger financial problems down the road. Build a budget focused on your needs rather than wants, and ask a trusted friend or advisor to review it for a reality check

Download your free guide to mastering taxes in retirement today!

Common Mistakes and How to Avoid Them

Waiting Too Long to Get Financial Advice

Do not rely on your attorney alone. Bring in a financial planner early.Letting Emotions Guide Big Decisions

Do not insist on keeping the house if you cannot afford it long term.Ignoring the Details of Asset Division

Pay attention to the true value and liquidity of what you receive.Forgetting About Taxes

Know that some assets come with future tax bills. Take after-tax value into account.Not Planning for the Future

Set up a savings account. Start building emergency savings and contribute to retirement plans as soon as possible.

Take These Steps to Regain Control

Steps to Regain Control After Divorce

Gather all financial documents and list assets and debts.

Build a realistic budget. Include all regular and irregular expenses.

Check your credit score and consider how divorce may affect your ability to get loans or housing.

Open your own savings and checking accounts.

Talk to a Certified Divorce Financial Analyst or similar expert.

Make sure your child support or alimony payments are secured with a legal order. You can also ask for a life insurance policy on your ex-spouse to guarantee you still get payments if something happens to them.

Resources for Women

Several organizations provide free financial guidance to women:

Women’s Institute for Financial Education (WIFE)

Women’s Institute for a Secure Retirement (WISER)

Financial Literacy Organization for Women and Girls (FLOW)

You can use their tools and advice to start planning for your financial future.

Bottom Line

Divorce changes everything. For women in the US, the biggest risks are a sudden drop in income, trouble covering bills, and getting shortchanged on retirement. With planning and the right team, you can rebuild your financial life. Focus on cash flow, understand your assets, secure support payments, and plan for long-term stability.

No one plans for divorce, but you can plan to protect yourself if it happens.

Download your free guide to mastering taxes in retirement today!

Reference

Northern Trust. (n.d.). Financial mistakes women make during the divorce process. Retrieved from https://www.northerntrust.com/united-states/institute/articles/financial-mistakes-women-make-during-the-divorce-process

Women’s Budget Group. (2025, March 12). The financial reality facing women on divorce. Retrieved from https://www.wbg.org.uk/article/the-financial-reality-facing-women-on-divorce/

Institute for Divorce Financial Analysts. (n.d.). Surviving financially after divorce. Retrieved from https://institutedfa.com/surviving-financially-after-divorce/

Legal & General Group. (2025, April 2). The divorce gap: Women see their household income cut in half in the year after a divorce. Retrieved from https://group.legalandgeneral.com/en/newsroom/press-releases/the-divorce-gap-women-see-their-household-income-cut-in-half-in-the-year-after-a-divorce

CNBC. (2024, March 23). Why gray divorce is a significant financial risk for women. Retrieved from https://www.cnbc.com/2024/03/23/why-gray-divorce-is-a-significant-financial-risk-for-women.html