Thoughtful Insights

Your trusted resource for mastering wealth management, financial planning, and smart investing. Explore thoughtfully curated articles, and clear, in-depth guides that help you to make informed decisions at every stage of your financial journey.

Tax Loss Harvesting+™ (The Right Way)

Watching the national news might lead a person to think we can’t seem to agree on anything anymore. But that’s not true! Finding common ground around tax time each year is easy. It seems that every one of us, regardless of career, demographics, or socio-economic status, is trying to minimize our income tax bill. Hopefully even to the point where we get a healthy refund!

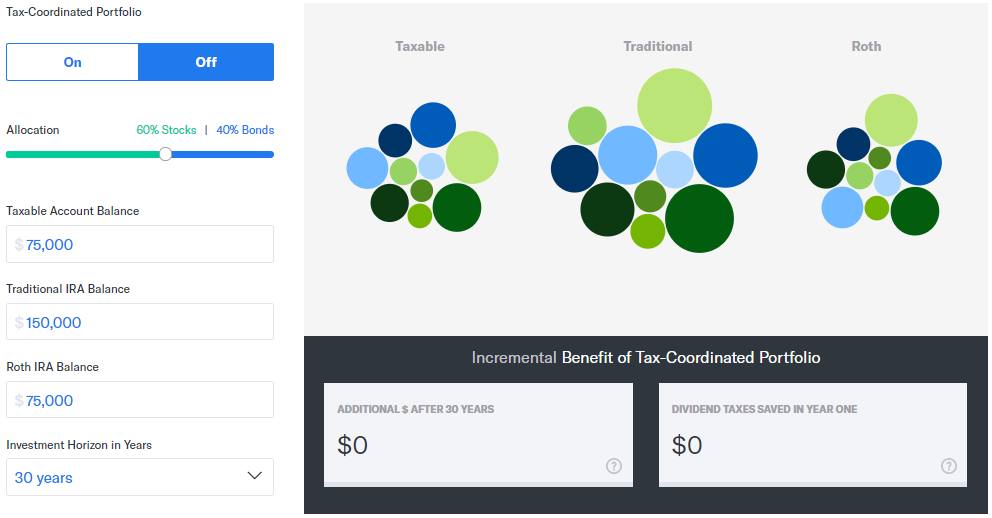

Investing Beyond Risk vs. Return

Using Tax Coordinated Portfolios to Increase Your Wealth; Not Your Risk

Be Aware of Changes Made to U.S. Tax Laws!

Recently there were substantial alterations made to the U.S. tax code. The Tax Cuts and Jobs Act was ultimately passed and signed in December 2017. It is imperative that you optimize the beneficial changes and minimize the negative changes for your family. This article summarizes how the Act changes some of the most prominent taxation issues affecting you going forward.

Cash Drag: Your Portfolio’s Subtle Downer

Do you remember way back in driver’s education class when the instructor said to keep your foot off the brake pedal when you’re driving unless you need to slow down or stop? Most people heed that warning. Especially when sitting next to a driving instructor!

How Employers can Help Improve the Financial Wellness of Minority Employees

In recognition of Minority Mental Health Month, it’s important to note this imbalance in minority preparedness for retirement. In order to alleviate the financial stress of your employees, certain steps can be taken in order to increase their financial health.

Save Money with this Fun Filled Vacation: Visit one of our National Parks

Summertime is in full swing which means vacations are just around the corner. According to a poll by The Associated Press-NORC Center for Public Affairs Research , nearly half of Americans say they don’t plan on taking a summer vacation this year, mainly because they can’t afford it. Trips can be costly with airfare, hotel expenses, restaurant meals and more quickly tallying up. It can be difficult to manage expenses when on vacation, however it’s still possible to have fun and indulge without breaking the bank.

Women and Retirement: Seventeen Surprising Facts and How to Approach Them

The number of wealthy women in the United States is rising twice as fast as the number of wealthy men according to CNBC. Many experts estimate that by 2030, women will control as much as two-thirds of the nation’s wealth. As these indicators all pointing to financial risings for females, it is important that women plan their retirement savings accordingly.

Factoring in Health Care Costs when Saving for Retirement

One of the biggest issues in retirement remains the cost of health. With the enjoyment of a longer retirement comes the cost of extended healthcare coverage. Furthermore, healthcare costs are increasing more than two-and-a-half times the rate of inflation. Additionally, as life expectancy rates continue to climb, so does the amount of money needed to sustain an individual’s costs over his or her lifespan.

How Stay-at-Home Spouses Can Better Prepare for Retirement

A Federal Reserve report on the economic well-being of U.S. households in 2015 found, among other things, that 31 percent of non-retirees reportedly “have no retirement savings or pension whatsoever.” Where households are supported by two incomes, some may only have one spouse contributing to the retirement fund. As they approach retirement age, many couples are left wondering how they can contribute to the nest egg.

SEP IRA: The Roadmap to Retirement for Self-Employed Individuals

In today’s workforce, a variety of employment models are becoming increasingly prevalent. Ideas of traditional employment are shifting, especially in regards to self-employed individuals. Whether you are a freelancer, independent contractor or another form of self-employed, making smart choices in saving for retirement is important.

How Spending after Children Leave Home is Worsening the Retirement Crisis

It has been long assumed that once children grow up and leave home, reductions in spending will follow as parents handle a more disposable income. However, recent findings have shown that many households aren’t showing an increase in savings as one may expect. For many empty-nesters, a later in life savings jump is crucial for families that have been supporting their children for the past 20-some-odd years. According to certain estimates, empty-nester’s savings are supposed to increase by as much as 12 percentage points. But a recent study performed by the Boston College Center for Retirement Research found that 401(k) savings plans are only showing a mere increase in saving of 0.3% to 0.7%.

Retirement Check-Up: What Your Finances Should Look Like in Your 50’s

Many 50-somethings are at some sort of crossroads in life. Several major events like getting married, having kids or buying a house have already happened to them. Their children are growing up, becoming financially independent and could be headed off to college in the fall or are even beginning to start a family of their own. When expenses start to taper off, it is the ideal time for 50-somethings to take a closer look at their retirement savings and start ramping up contributions, especially if they aren’t on track to reach their goals.

Don’t Let Your Wedding Break the Bank: How to Budget and Plan Accordingly on Your Big Day

Nowadays, the cost of a wedding amounts to a small fortune. Whether you waited until later in life to tie the knot, are starting over with another marriage or plan to contribute to your child’s wedding, don’t let it derail your life’s savings. There’s a healthy balance of having a dream wedding and not breaking the bank. In order to do this, you must create a budget that includes all the details, find creative ways to save money and remember that at the end of the day it’s not about the wedding itself, but a celebration of a lifelong commitment.

Not Saving For Retirement? Here’s Why You Should Start Now

There are many reasons why you haven’t starting thinking about your retirement. You might think that because it’s so far away you have plenty of time to put it off for another few years. According to psychologist Daniel Goldstein, it can be difficult for many people to imagine themselves growing old. In our heads, we all realize we will grow old, but the concept doesn’t seem real to us. We often don’t even want to think about it -- let alone plan for it.

Easy Hacks For Saving Money on a Memorial Weekend Getaway

Whether you’ve already arranged a Memorial Day weekend getaway or are waiting until the last minute to make travel plans, whatever you do, you certainly won’t want to miss out on the first opportunity to take a summer vacation. In fact, you’ll be amazed at how much you can see and experience during the long weekend. Learn about three easy ways to save the most money on your getaway, no matter your destination.

Three Ways Millennials Are Managing (and Saving) Money

It’s no secret that life for twenty-somethings is vastly different than it was in the 1970’s, 80’s or even 90’s. The internet and mobile technology have completely changed how we carry out our professional and personal lives. Personal finance is yet another area in which millennials are doing things a little differently than their parents and grandparents.

Three Steps for Helping Family Members Who Struggle With Finances

It’s never easy to watch family members struggle with their finances. Even though it can be tempting to loan them money, it is only a temporary fix that won’t last if they’ve instilled bad money habits in their financial routine. When it comes to addressing your concerns with a family member who’s struggling with money management, it can be scary. On one hand, you want your loved one to get his or her financial situation under control, but you don't want to destroy your relationship in the process. Read on to learn more about how to better help family members who are bad at money.

Three Financial Challenges Holding Millennials Back from Starting a Family

Millennials now account for the majority of new and expecting parents. By growing up during the greatest economic downturn since the Great Depression and holding more student loan debt than any previous generation, millennials are faced with a very unique set of challenges when it comes to starting a family. With the cost of raising a child now equalling a small fortune, millennial parents need to be better prepared financially.

Three Lessons for Teaching Your Children Good Financial Habits

In order to raise financially savvy children, parents must begin to teach them a variety of skillsets like budgeting, planning, earning and saving.

How Technology Can Save You Money: Best Mobile Apps for Financial Fitness

When your budget is tight, saving for your future can be especially difficult. We live in a world where the vast majority of mobile apps are designed to help you spend money, not save it, with simple “one click” checkout experiences. Fortunately, there are a few apps on the market that have actually made it a little bit easier to make saving a priority in your everyday life.