Thoughtful Insights

Your trusted resource for mastering wealth management, financial planning, and smart investing. Explore thoughtfully curated articles, and clear, in-depth guides that help you to make informed decisions at every stage of your financial journey.

How to Catch Up When You’re Behind on Saving for Retirement

If you’re worried that you haven’t saved enough for retirement, then you’re not alone. Nearly half of American families have no retirement savings to speak of. It really is easy to get sidetracked. The immediate needs of raising a family may seem to take precedence over funding a future retirement. However, that retirement will come sooner than you think.

If you’re behind on your savings, here are six steps to help catch up.

What You Should Do During Medicare’s Open Enrollment

Medicare’s open enrollment begins this month, and if you are already receiving Medicare, now is an ideal time to review your coverage. Even if you plan to keep the coverage you have, you should make sure you take a look at your plans’ changes for 2019, such as price increases for prescription drugs. By taking a little time now to review your options, you may be able to get a better deal, can help prevent expensive surprises later, and can feel confident that you have the right coverage—at least, until next year’s open enrollment.

Making an Estate Plan? Don’t Forget Your Digital Assets

The digital revolution has enriched our lives in many ways. We can stay in more frequent contact with family across the country, meet new friends around the world, enjoy the convenience of online banking, and buy practically anything we need without leaving the home.

Social Security for Divorcees

Many people are aware that married couples can receive Social Security based on their spouse’s work record. But what a lot of people don’t know is that divorced individuals can do so too. This option could help increase your Social Security benefits in retirement, although you should be aware of the caveats as well.

Is a Cash Balance Plan Right for You? The Pros and Cons

Cash balance plans are an increasingly popular retirement planning tool. Given their generous contribution limits, you could quickly build a sizable nest egg while reducing your income taxes. But are these plans right for you? To help you decide, we take a look at what they are, who they work best for, and their potential pros and cons.

5-Minute Financial Risk Assessment

Every day talented CRNAs perform pre-anesthesia evaluations on their patients. In essence, CRNAs perform indispensable patient risk assessments before administering anesthesia. If the evaluation does not look satisfactory then a surgery postponement or cancellation may be necessary. Patient safety always comes first! Otherwise, the results can be catastrophic.

Does a Reverse Mortgage Ever Make Sense as Part of a Retirement Portfolio?

For most people, their greatest asset when they hit retirement is not their 401(k) account. Rather, it is the home in which they live. Until fairly recently there was never an economical way to access that value without selling the home. Let’s be honest; you still need to live somewhere, so selling your home may not be much of an option.

Tax Loss Harvesting+™ (The Right Way)

Watching the national news might lead a person to think we can’t seem to agree on anything anymore. But that’s not true! Finding common ground around tax time each year is easy. It seems that every one of us, regardless of career, demographics, or socio-economic status, is trying to minimize our income tax bill. Hopefully even to the point where we get a healthy refund!

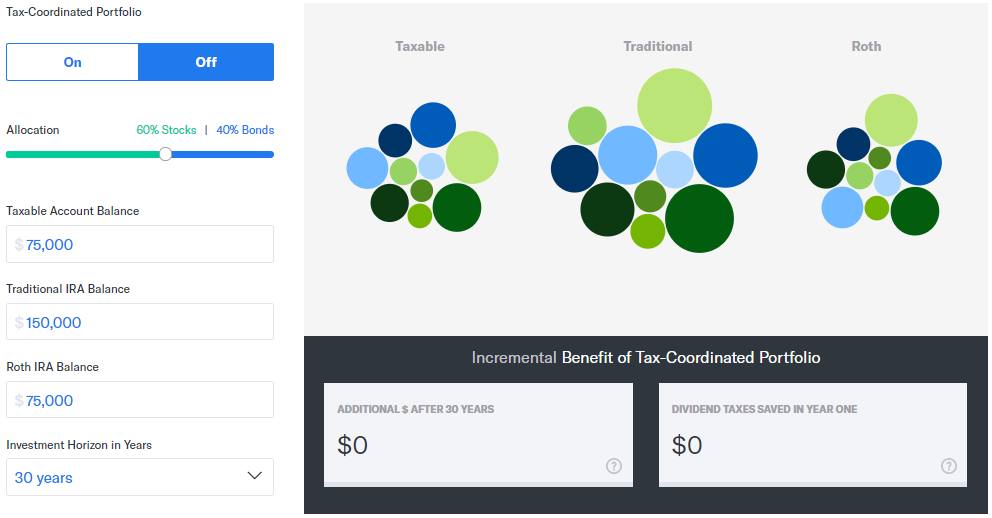

Investing Beyond Risk vs. Return

Using Tax Coordinated Portfolios to Increase Your Wealth; Not Your Risk

Be Aware of Changes Made to U.S. Tax Laws!

Recently there were substantial alterations made to the U.S. tax code. The Tax Cuts and Jobs Act was ultimately passed and signed in December 2017. It is imperative that you optimize the beneficial changes and minimize the negative changes for your family. This article summarizes how the Act changes some of the most prominent taxation issues affecting you going forward.

Cash Drag: Your Portfolio’s Subtle Downer

Do you remember way back in driver’s education class when the instructor said to keep your foot off the brake pedal when you’re driving unless you need to slow down or stop? Most people heed that warning. Especially when sitting next to a driving instructor!

How Employers can Help Improve the Financial Wellness of Minority Employees

In recognition of Minority Mental Health Month, it’s important to note this imbalance in minority preparedness for retirement. In order to alleviate the financial stress of your employees, certain steps can be taken in order to increase their financial health.

Save Money with this Fun Filled Vacation: Visit one of our National Parks

Summertime is in full swing which means vacations are just around the corner. According to a poll by The Associated Press-NORC Center for Public Affairs Research , nearly half of Americans say they don’t plan on taking a summer vacation this year, mainly because they can’t afford it. Trips can be costly with airfare, hotel expenses, restaurant meals and more quickly tallying up. It can be difficult to manage expenses when on vacation, however it’s still possible to have fun and indulge without breaking the bank.

Women and Retirement: Seventeen Surprising Facts and How to Approach Them

The number of wealthy women in the United States is rising twice as fast as the number of wealthy men according to CNBC. Many experts estimate that by 2030, women will control as much as two-thirds of the nation’s wealth. As these indicators all pointing to financial risings for females, it is important that women plan their retirement savings accordingly.

Factoring in Health Care Costs when Saving for Retirement

One of the biggest issues in retirement remains the cost of health. With the enjoyment of a longer retirement comes the cost of extended healthcare coverage. Furthermore, healthcare costs are increasing more than two-and-a-half times the rate of inflation. Additionally, as life expectancy rates continue to climb, so does the amount of money needed to sustain an individual’s costs over his or her lifespan.

How Stay-at-Home Spouses Can Better Prepare for Retirement

A Federal Reserve report on the economic well-being of U.S. households in 2015 found, among other things, that 31 percent of non-retirees reportedly “have no retirement savings or pension whatsoever.” Where households are supported by two incomes, some may only have one spouse contributing to the retirement fund. As they approach retirement age, many couples are left wondering how they can contribute to the nest egg.

SEP IRA: The Roadmap to Retirement for Self-Employed Individuals

In today’s workforce, a variety of employment models are becoming increasingly prevalent. Ideas of traditional employment are shifting, especially in regards to self-employed individuals. Whether you are a freelancer, independent contractor or another form of self-employed, making smart choices in saving for retirement is important.

How Spending after Children Leave Home is Worsening the Retirement Crisis

It has been long assumed that once children grow up and leave home, reductions in spending will follow as parents handle a more disposable income. However, recent findings have shown that many households aren’t showing an increase in savings as one may expect. For many empty-nesters, a later in life savings jump is crucial for families that have been supporting their children for the past 20-some-odd years. According to certain estimates, empty-nester’s savings are supposed to increase by as much as 12 percentage points. But a recent study performed by the Boston College Center for Retirement Research found that 401(k) savings plans are only showing a mere increase in saving of 0.3% to 0.7%.

Retirement Check-Up: What Your Finances Should Look Like in Your 50’s

Many 50-somethings are at some sort of crossroads in life. Several major events like getting married, having kids or buying a house have already happened to them. Their children are growing up, becoming financially independent and could be headed off to college in the fall or are even beginning to start a family of their own. When expenses start to taper off, it is the ideal time for 50-somethings to take a closer look at their retirement savings and start ramping up contributions, especially if they aren’t on track to reach their goals.

Don’t Let Your Wedding Break the Bank: How to Budget and Plan Accordingly on Your Big Day

Nowadays, the cost of a wedding amounts to a small fortune. Whether you waited until later in life to tie the knot, are starting over with another marriage or plan to contribute to your child’s wedding, don’t let it derail your life’s savings. There’s a healthy balance of having a dream wedding and not breaking the bank. In order to do this, you must create a budget that includes all the details, find creative ways to save money and remember that at the end of the day it’s not about the wedding itself, but a celebration of a lifelong commitment.