Top 10 Common RMD and Withdrawal Mistakes for Raytheon Retirees

Raytheon retirees face complex retirement income patterns due to pensions, Social Security, legacy 401k plans, and updated Required Minimum Distribution rules. Small missteps can create large penalties, trigger higher Medicare costs, and raise lifetime tax bills. The following guide details the Top 10 Common RMD and Withdrawal Mistakes based on current law, recent Secure Act updates, and common errors seen among Raytheon retirees

1. Ignoring 401k RMDs or Taking Them From the Wrong Account

Many Raytheon veterans assume that taking an RMD from any account satisfies all RMD obligations. This is incorrect. You can take total RMDs for IRAs from any IRA you choose, but each 401k must satisfy its own RMD separately. Missing this rule triggers a 25 percent IRS penalty on the amount not withdrawn.

2. Waiting Too Long to Prepare for RMDs

Planning at age 73 is too late for many Raytheon engineers and technicians. When a pension, Social Security, and delayed RMDs start at the same time, income stacks quickly and pushes retirees into higher tax brackets. Strategic planning in the early 60s provides more room for Roth conversions and targeted drawdown strategies.

3. Not Coordinating Pension, Social Security, and RMD Income

Raytheon’s defined benefit pension is steady income. When combined with Social Security and required withdrawals, many retirees move into higher tax brackets and face Income Related Monthly Adjustment Amount surcharges on Medicare premiums. Integrated planning is essential to avoid income spikes.

4. Delaying the First RMD Without Understanding the Consequences

You may delay the first RMD until April 1 of the following year. Many retirees choose this without realizing it forces them to take two RMDs in the same year, which can increase taxes and Medicare costs.

5. Missing the Still Working Exception

If you continue to work at Raytheon past age 73 and own less than 5 percent of the company, you can delay 401k RMDs until retirement. Many employees miss this rule and withdraw money unnecessarily while still earning full income.

Infographic 10 Common RMD and Withdrawal Mistakes

6. Miscalculating the RMD Amount

RMDs use your prior year end balance and the IRS life expectancy tables. Errors occur when retirees choose the wrong table or use the wrong balance. Underestimating generates a penalty. Overestimating increases taxation unnecessarily.

7. Taking a Taxable Distribution Instead of a Direct Rollover

Some Raytheon retirees attempt to move their 401k to an IRA by withdrawing the funds first. This triggers a mandatory 20 percent federal withholding and gives you only 60 days to redeposit the full balance. A trustee to trustee transfer avoids this problem entirely.

8. Overlooking Tax Advantaged Giving Strategies

Qualified Charitable Distributions allow retirees over age 70 and one half to donate directly from their IRA. The distribution counts toward their RMD and does not raise taxable income. Many Raytheon retirees miss this strategy even though it reduces taxes and supports charitable goals.

9. Triggering Early Withdrawal Penalties

Accessing funds before the eligible age can trigger penalties and higher taxes. Many individuals unknowingly pull money from accounts that do not qualify for early withdrawal exceptions. Withdrawal timing is critical in a tax deferred system.

10. Limiting Withdrawals to Only the Minimum

Taking only the exact RMD each year may increase future tax burdens. Some income years allow retirees to withdraw more strategically to manage future RMD sizes and protect long term tax control. This approach reduces later tax spikes and fits multi year tax planning.

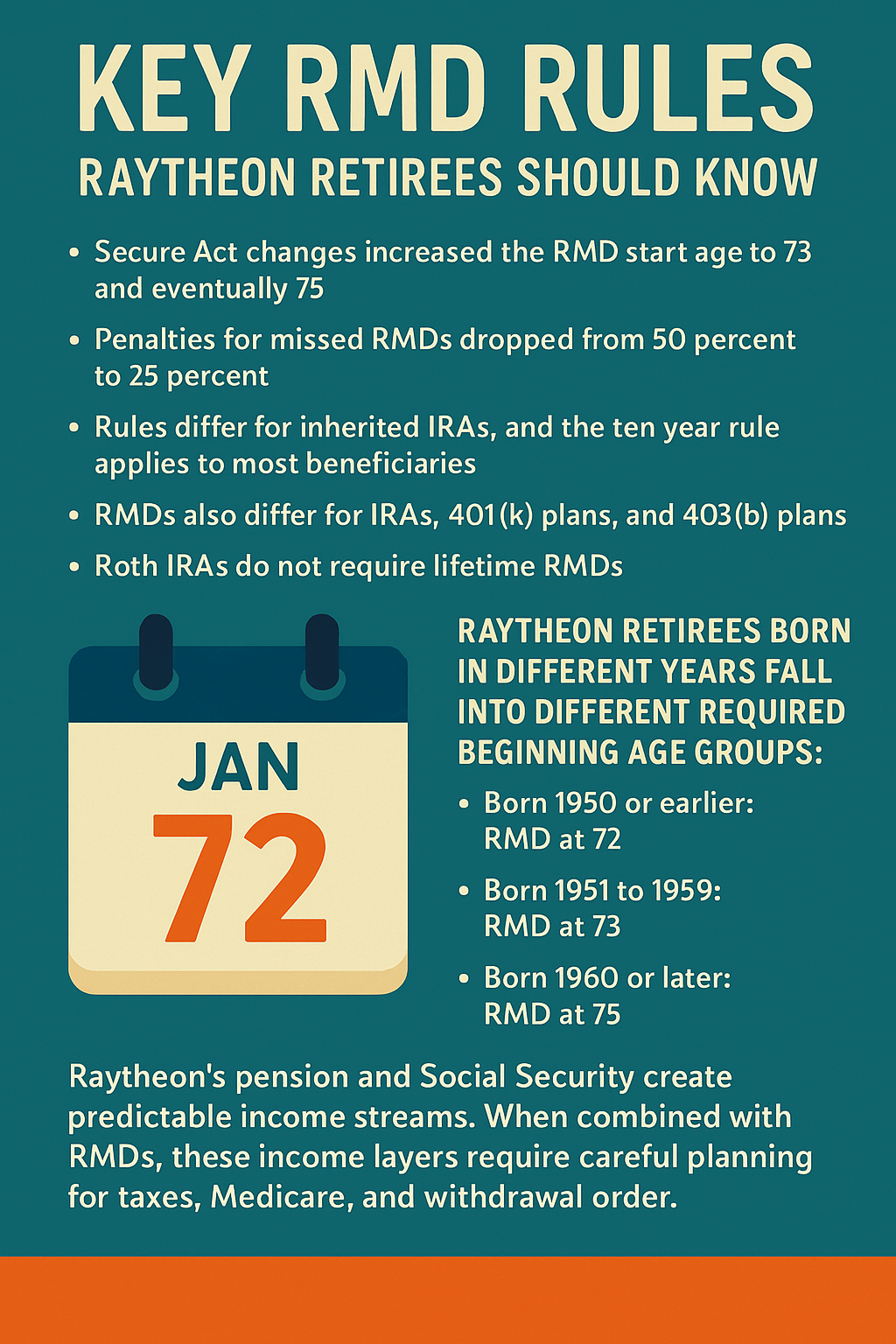

Key RMD Rules Raytheon Retirees Should Know

Secure Act changes increased the RMD start age to 73 and eventually 75. Penalties for missed RMDs dropped from 50 percent to 25 percent. Rules differ for inherited IRAs, and the ten year rule applies to most beneficiaries. RMDs also differ for IRAs, 401k plans, and 403b plans. Roth IRAs do not require lifetime RMDs.

Note: Certain eligible designated beneficiaries such as surviving spouses, minor children, and disabled or chronically ill individuals may qualify for exceptions to the 10-year distribution rule.

Infographic Key RMD Rules

Raytheon retirees born in different years fall into different required beginning age groups:

• Born 1950 or earlier: RMD at 72

• Born 1951 to 1959: RMD at 73

• Born 1960 or later: RMD at 75

Raytheon’s pension and Social Security create predictable income streams. When combined with RMDs, these income layers require careful planning for taxes, Medicare, and withdrawal order.

Note: Individuals born before July 1, 1949 were subject to the old age 70½ rule. Those born in 1950 typically began RMDs in 2022 (age 72) under prior law. The current SECURE 2.0 rules apply to those turning 73 after 2022 and 75 after 2032.

Why RMD Planning Matters for Raytheon Veterans

Raytheon veterans often underestimate the impact of pension income combined with required distributions. Without planning, the combination of pension payments, Social Security, and rising RMDs can create years of elevated taxation and Medicare surcharges. Securing a coordinated withdrawal strategy ensures a smoother income path and prevents penalties that erode retirement savings.

How ONE Advisory Partners Supports You

RMD rules, pension income, and withdrawal decisions can feel overwhelming when you rely on your savings to fund the next chapter of your life. Jeffrey Davis AAMS® helps you understand your choices so you can make clear, informed decisions. At ONE Advisory Partners, you get guidance that fits your full financial picture and supports the retirement lifestyle you want.

Jeff reviews your income needs, investment strategy, tax exposure, and long term goals. He builds a coordinated plan that manages RMD timing, withdrawal order, account structure, and portfolio decisions. You get clarity instead of guesswork, plus a plan that matches the way you live and the future you want to protect.

You do not need to sort out the rules alone. Jeff helps you compare scenarios, understand the tax impact of each option, and choose the approach that gives you steady retirement income with fewer surprises. If you want support with retirement planning, taxes, investment management, or financial life planning, schedule an appointment with Jeffrey Davis AAMS®, Wealth Advisor at ONE Advisory Partners, based in Santa Barbara CA and serving clients nationwide.

The Bottom Line

RMD mistakes can shrink your retirement savings through penalties, higher taxes, and poor withdrawal timing. When you coordinate your pension, Social Security, investment withdrawals, and tax plan, you protect your income and avoid costly errors. Raytheon retirees who plan early, calculate accurately, and choose the right withdrawal order keep more of their money and gain more control over their retirement.

If you want help building a clear, tax aware RMD strategy that fits your income, goals, and long term plan, connect with Jeffrey Davis AAMS® at ONE Advisory Partners. He helps you understand your options, compare scenarios, and create a retirement plan that keeps your income steady and your future secure.

Common RMD and Withdrawal for Raytheon Veterans FAQs

What is an RMD and when do Raytheon retirees need to start withdrawing?

An RMD is the required minimum amount you must withdraw from qualified retirement accounts starting at age 73 for most retirees. Raytheon retirees born in 1950 or earlier follow the older age 72 rule. IRAs and 401k plans each follow separate withdrawal rules.

Can I take my total RMD from one Raytheon account?

You can take the total RMD from any IRA when you have multiple IRAs, but you cannot combine RMDs across different 401k plans. Each 401k plan must distribute its own RMD.

What happens if I delay my first RMD?

You may delay the first RMD until April 1 of the next year. Doing so forces two RMDs in one year, which increases taxable income and can raise Medicare premiums.

Does the Still Working Exception apply to Raytheon employees?

Yes. If you are still employed by Raytheon at age 73 and own less than 5 percent of the company, you may delay 401k RMDs until retirement.

Do Roth IRAs require RMDs?

Roth IRAs do not require lifetime RMDs. Inherited Roth IRAs have separate rules that follow the ten year distribution requirement.

What is the penalty for missing an RMD?

The IRS charges a 25 percent penalty on the amount not withdrawn. If corrected in time, the penalty may drop to 10 percent.

Can I use charitable giving to meet my RMD?

Yes. A Qualified Charitable Distribution allows you to donate directly from your IRA. The amount counts toward your RMD without increasing taxable income

Reference

Wells Fargo Private Bank. (2024). SECURE Act 2.0: What You Need to Know About New Retirement Savings and Distribution Rules. Retrieved from https://www.wellsfargo.com/the-private-bank/insights/apu-secure-act

Internal Revenue Service. (n.d.). Retirement Topics: Beneficiary. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary

Internal Revenue Service. (n.d.). Publication 590-B: Distributions from Individual Retirement Arrangements (IRAs). Retrieved from https://www.irs.gov/publications/p590b

Internal Revenue Service. (n.d.). Required Minimum Distributions FAQs. Retrieved from https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

Investopedia. (n.d.). Are 401k Contributions Tax Deductible? Retrieved from https://www.investopedia.com/ask/answers/112515/are-401k-contributions-tax-deductible.asp