How Can a 529 Plan Help You Prepare for Rising Education Costs

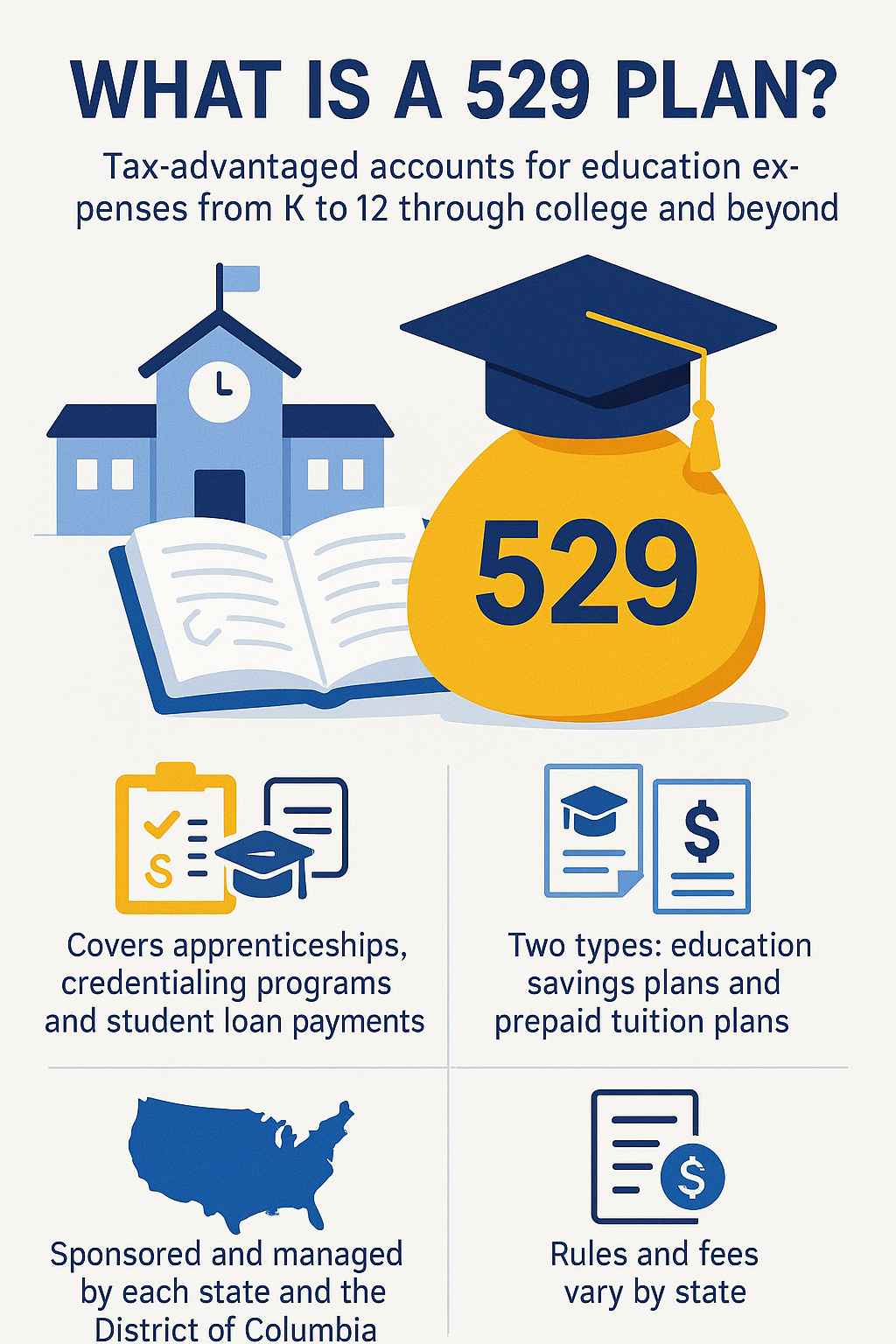

Rising education costs make it harder for families to plan ahead. A 529 plan gives you a simple way to save for school while keeping more of your money working for you. It offers tax-free growth, flexible rules, and broad coverage across K-12, college, apprenticeships, and even student loan payments.

This guide breaks down how 529 plans work, who can use them, and what benefits and limits to consider before you open an account.

What a 529 Plan Is

A 529 plan is a state sponsored savings account that grows tax-free when you use the money for qualified education expenses. The plan can pay for tuition, fees, books, room and board, and even computers and internet service used for schoolwork. You can use a 529 plan for college, many apprenticeship programs, K-12 tuition, student loan payments, and certain credentialing programs.

Congress created these plans in 1996. Since then, lawmakers expanded their use several times. Recent legislation increased the list of approved expenses and added features like student loan repayment and Roth IRA rollovers for leftover funds.

Why Families Choose 529 Plans

The main benefit is simple. Your money grows without federal tax and usually without state tax as long as you use it for qualified education expenses. This allows more of your savings to go directly to tuition rather than to taxes.

A 529 plan also gives you control. The account owner manages the funds and decides when to withdraw money. You can even change the beneficiary to another family member if plans change.

Another major benefit is flexibility. You can choose any state’s plan, compare fees and performance, and move the money to another eligible plan if needed.

Savings Plans and Prepaid Tuition Plans

There are two types of 529 plans. Savings plans are the most popular. You invest money in a menu of investment options that grow over time. Many plans offer age based funds that adjust as the student gets older. You can withdraw the funds for qualified expenses for both K-12 and college.

Prepaid tuition plans work differently. You pay in advance for future tuition at participating colleges and universities. This lets you lock in current tuition costs. Prepaid plans do not cover room and board and may limit where the student can attend school.

Who Can Open a 529 Plan

Anyone can open a 529 plan. Parents, grandparents, relatives, friends, and even the student can start an account. There are no income limits and no limit to the number of plans you can create.

Contribution limits depend on each state. Most states cap the total amount you can contribute over time, often between two hundred thirty five thousand and six hundred twenty thousand dollars.

What You Can Use 529 Plan Funds For

The list of qualified expenses is broad. You can use the money for:

Tuition and fees

Books and supplies

Room and board

Computers, software, and internet needed for school

Apprenticeship program costs

Student loan payments up to ten thousand dollars

K-12 tuition up to ten thousand dollars per year, rising to twenty thousand in 2026

Certain credentialing programs

Withdrawals for non-qualified expenses trigger taxes and a ten percent penalty on earnings.

Tax Benefits of a 529 Plan

Your contributions are not deductible on your federal tax return. The benefit appears over time through tax-free growth and tax-free withdrawals for qualified expenses.

On the state level, more than thirty states offer tax deductions or credits for contributions. In some states, any contributor can claim the benefit. A few states only allow the account owner or the account owner’s spouse to claim it. Nine states allow deductions for contributions to any state’s plan rather than only their own.

If you want to claim a state tax benefit, you usually need to contribute by December 31. A small number of states give you until April to make a contribution for the prior tax year.

Special Gift Tax Rules

The annual gift tax exclusion increased to $19,000 per person in 2025. You can also front load a 529 plan by contributing up to five years’ worth of exclusions at once. For example, you can give $95,000 in a single year to a beneficiary without triggering gift tax, as long as you make no further gifts to that same person during the next five years.

Comparing 529 Plans to Brokerage Accounts

A brokerage account lets you invest in anything you want and withdraw funds freely. However, you pay tax on gains and dividends each year and there are no education based tax breaks.

A 529 plan limits your investment options but rewards you with tax-free growth when you use the money for education. If the student chooses not to pursue higher education, you can change the beneficiary, use the funds for apprenticeships or loan payments, or roll up to thirty five thousand dollars into a Roth IRA when the account meets the requirements.

What It Costs to Maintain a 529 Plan

Plans often charge a small annual fee, usually 0 to $25. Funds inside the plan may also carry management fees. Many families look for low cost index funds to keep expenses down. If you use a financial advisor to manage the plan, you may pay an additional fee based on assets.

Common Misunderstandings

Some families worry that they must use their own state’s plan. You can choose any state’s plan. Some states offer incentives to attract you, but you are not restricted. Others assume that the beneficiary gains full control when they turn eighteen. While the beneficiary may take ownership, the funds still must be used for qualified education expenses.

Many parents also fear that leftover funds will be wasted. In reality, you have several choices including beneficiary changes, graduate school expenses, student loan repayment, and Roth IRA rollovers.

How ONE Advisory Partners Can Help

When your finances feel scattered across investments, taxes, retirement income and long term goals, making confident decisions becomes harder. Scott A. Rojas helps you bring every piece together with a clear and steady approach. He draws on two decades of experience in financial life planning, tax smart investing, retirement strategy and portfolio design to turn complex choices into practical steps you can use.

You do not need to plan your financial future on your own. If you want guidance on growing your wealth, preparing for retirement or creating a flexible long term plan, schedule an appointment with Scott A. Rojas at ONE Advisory Partners.

The Bottom Line

A 529 plan gives you a structured way to save for education with powerful tax benefits. It helps you prepare for rising tuition costs across K-12 education, college, apprenticeships, and beyond. You remain in control of the account and can adjust the plan as your family’s needs change. For many families, it is one of the most flexible and tax efficient ways to save for education.

Common Questions About 529 Plans

What is a 529 plan used for

A 529 plan pays for education expenses such as tuition, books, fees, room and board, computers, software, internet, apprenticeships, student loan payments, and K-12 tuition.

Do 529 plans grow tax-free

Yes. Earnings grow without federal tax and withdrawals remain tax-free when you use the funds for qualified education expenses.

Can anyone open a 529 plan

Yes. Parents, grandparents, relatives, friends, and even the student can open an account. There are no income limits.

What happens if the student does not go to college

You can change the beneficiary to another family member, keep the account for future education, use funds for apprenticeships or loan payments, or roll up to thirty five thousand dollars into a Roth IRA.

Are 529 plan contributions tax-deductible

They are not deductible on your federal taxes. Many states offer a deduction or credit when you contribute.

Can you use a 529 plan for K-12

Yes. You can use up to ten thousand dollars each year for K-12 tuition, rising to twenty thousand dollars starting in 2026 in some cases.

Can grandparents claim a tax deduction for contributions

Most states allow grandparents to claim a state tax deduction or credit for their contributions.

Reference

Internal Revenue Service. (2025). 529 Plans: Questions and Answers. IRS. Retrieved from https://www.irs.gov/newsroom/529-plans-questions-and-answers

Saving for College. (2025). How Much Is Your State’s 529 Plan Tax Deduction Really Worth. Savingforcollege.com. Retrieved from https://www.savingforcollege.com/article/how-much-is-your-state-s-529-plan-tax-deduction-really-worth

Investopedia Staff. (2025). 529 Plan Definition and How It Works. Investopedia. Retrieved from https://www.investopedia.com/terms/1/529plan.asp

College Savings Plans Network. (2025). What Is a 529 Plan. CSPN. Retrieved from https://www.collegesavings.org/what-is-529

National Association of State Treasurers. (2025). College Savings. NAST. Retrieved from https://nast.org/college-savings/