The Spousal IRA Advantage Many Couples Overlook

Most couples assume retirement savings stop when one spouse stops working, but that assumption costs families years of tax advantaged growth. A spousal IRA closes this gap by allowing both spouses to continue saving for retirement as long as they file jointly and one spouse earns income, even if the other earns little or nothing. This often overlooked rule can double a household’s annual retirement contributions and strengthen long-term financial security.

What Is Spousal IRA

A spousal IRA is not a special account. It is a standard traditional IRA or Roth IRA opened in the name of the lower earning or non-working spouse. The working spouse funds the contribution, but ownership always belongs to the spouse whose name is on the account

Each spouse must have their own IRA. Joint IRAs do not exist. The spousal IRA simply uses the working spouse’s earned income to qualify both accounts.

DOWNLOAD YOUR FREE GUIDE HERE

Who Qualifies for a Spousal IRA

To qualify for a spousal IRA, you must be legally married and file a joint tax return. The working spouse must earn enough income to cover the total contributions made to both IRAs.

This rule lets you keep saving for retirement even if one spouse stays home, earns little income, or no longer works, as long as your household has sufficient earned income.

Contribution Limits You Can Use Today

For 2024 and 2025, each spouse can contribute up to 7,000 per year. If age 50 or older, each spouse can contribute up to 8,000 per year. That means a married couple can contribute up to 14,000 or 16000 annually using a spousal IRA strategy.

The contribution deadline follows standard IRA rules. You can fund the account up until the tax filing deadline for that year. For most households, that means mid April of the following year.

DOWNLOAD YOUR FREE GUIDE HERE

Traditional vs Roth for a Spousal IRA

You choose between a traditional IRA and a Roth IRA for the spousal account. The decision affects taxes today and taxes later.

A traditional spousal IRA may reduce taxable income now. Contributions may be deductible depending on income and whether either spouse participates in a workplace retirement plan.

A Roth spousal IRA does not provide a deduction today. It offers tax free growth and tax free withdrawals later if rules are met.

The IRS applies the same income phaseouts to spousal IRAs as it does to any other IRA. For Roth IRAs in 2025, married couples filing jointly can contribute the full amount if modified adjusted gross income stays below 236,000. Partial contributions apply up to 246,000. Above that level, direct Roth contributions stop.

How the Deduction Rules Work

Many couples assume spousal IRA deductions disappear once income rises. That is not always true.

If neither spouse participates in a workplace retirement plan, traditional IRA contributions remain fully deductible regardless of income. This rule surprises many households where one spouse stays home and the other works for a small business without a retirement plan.

If one spouse participates in a workplace plan, the deduction phases out based on income. The IRS sets different thresholds depending on which spouse holds the plan. These thresholds change periodically, so annual review matters.

Why Ownership Matters

The spousal IRA belongs to the spouse whose name appears on the account. That ownership matters for estate planning, divorce planning, and retirement income planning.

The working spouse cannot reclaim the funds later. Once contributed, the assets belong fully to the account holder. This structure protects retirement savings and ensures both spouses build independent long term security.

The Power of Two IRAs Over Time

Small monthly contributions compound into meaningful results when both spouses save.

A monthly contribution of 550 invested at a modest 5 percent annual return can grow to roughly 330,000 over 25 years. Fund two IRAs instead of one and that figure doubles. The difference often decides whether retirement feels tight or flexible.

Time matters more than precision. Couples who delay because one spouse does not work give up years of compound growth.

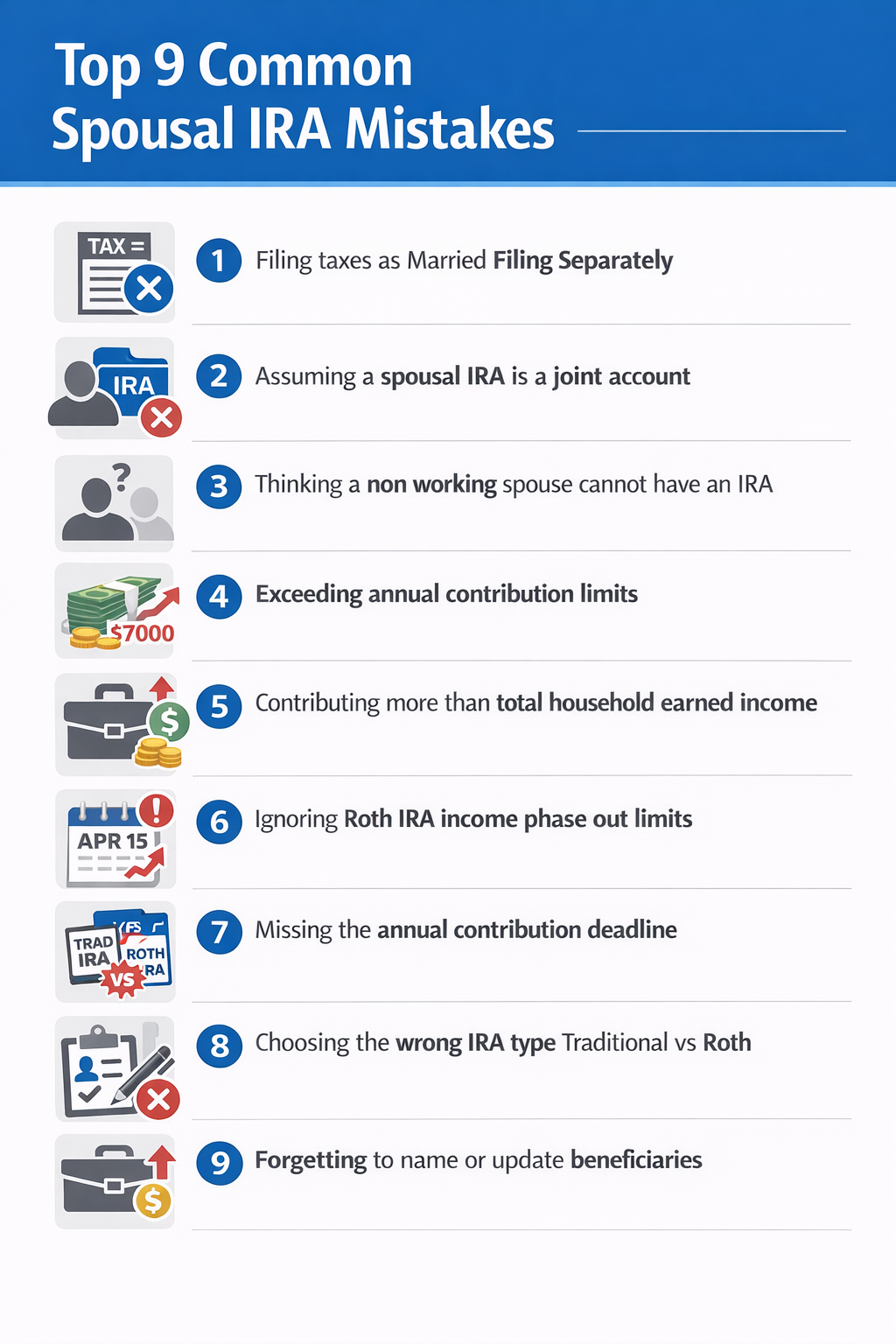

Common Mistakes to Avoid

When managing a spousal IRA, avoiding common errors in eligibility, contributions, and account management is crucial to maximize savings and prevent penalties.

When a Spousal IRA Makes the Biggest Difference

Spousal IRAs work best during career gaps. They shine when one spouse leaves the workforce to raise children, care for parents or step back from full time work. They also help households where one spouse earns significantly less than the other.

They also support tax planning. Strategic use of traditional and Roth spousal IRAs helps manage future tax brackets, control taxable income and smooth retirement withdrawals.

How One Advisory Partners Helps You

If you want help deciding between traditional and Roth options or coordinating a spousal IRA with your broader retirement plan, Christel Turkiewicz, CRPC®, CDFA®, can guide you through those decisions with clarity and care. As a Wealth Advisor at ONE Advisory Partners, she helps individuals and couples align spousal IRA strategies with retirement income planning, tax decisions, and long-term goals.

With more than 30 years of experience in accounting, finance, and wealth management, Christel specializes in retirement planning, taxes, estate planning, and major life transitions such as divorce or the loss of a spouse.

DOWNLOAD YOUR FREE GUIDE HERE

The Bottom Line

A spousal IRA turns one paycheck into two retirement plans. It allows couples to keep saving even when careers pause or incomes shift. The rules remain simple. The benefits compound quietly year after year.

If you file jointly and earn income, you likely qualify. Ignoring the spousal IRA leaves retirement savings on the table. Using it gives both spouses ownership security and long-term flexibility that many couples never realize exists.

If you want help deciding between traditional and Roth options or coordinating a spousal IRA with your broader retirement plan, working with a qualified advisor like Christel Turkiewicz, CRPC®, CDFA® can help you avoid mistakes and use the rules fully. Schedule an appointment here.

Frequently Asked Questions About Spousal IRAs

Can I use a spousal IRA if my spouse does not work?

Yes. If you file a joint tax return and one spouse has enough earned income, you can contribute to an IRA for a non-working or lower earning spouse.

Is a spousal IRA a joint account?

No. Each spouse must have their own IRA. The account belongs entirely to the spouse whose name is on it, even if the other spouse funds the contribution.

Should I choose a traditional or Roth spousal IRA?

That depends on your income, tax situation, and retirement goals. A traditional IRA may offer a tax deduction now, while a Roth IRA provides tax free withdrawals later.

How much can we contribute using a spousal IRA?

For 2024 and 2025, each spouse can contribute up to 7000 per year, or 8000 if age 50 or older, as long as total earned income covers both contributions.

When does it make sense to get professional guidance?

Guidance helps when income is near IRS limits, one spouse has a workplace retirement plan, or you are navigating divorce, widowhood, or retirement transitions where IRA decisions have long-term tax impact.

Reference

Internal Revenue Service. (2025). Retirement topics IRA contribution limits. IRS. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

Internal Revenue Service. (2025). 401(k) limit increases to 23,500 for 2025; IRA limit remains 7,000. IRS. Retrieved from https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

Internal Revenue Service. (2025). Publication 590 A Contributions to Individual Retirement Arrangements IRAs. IRS. Retrieved from https://www.irs.gov/pub/irs-pdf/p590a.pdf

District Capital Management. (2025). Spousal IRA. Retrieved from https://districtcapitalmanagement.com/spousal-ira/

Investopedia Staff. (2025). Spousal IRA. Investopedia. Retrieved from https://www.investopedia.com/terms/s/spousal-ira.asp