Pension or Lump Sum Rollover and What Raytheon Engineers Need to Know

As Raytheon engineers approach retirement, the pension or lump sum rollover decision becomes a critical financial choice. This is not about which option looks larger on paper. It is about how income, risk, and flexibility hold up over time.

A pension offers predictable lifetime income. A lump sum rollover offers control and flexibility but shifts long term responsibility to you. Understanding how these tradeoffs play out over decades is key to making the right decision.

What a Raytheon Pension Provides

A Raytheon pension pays a fixed monthly income for as long as you live. Many plans include joint and survivor options that continue payments to a spouse after death.

This structure removes several retirement risks that matter more over time than early projections suggest.

You do not manage investments

You do not calculate withdrawal rates

You do not worry about market volatility reducing income

You do not risk outliving the payments

The company manages the pension assets. In many cases, federal pension insurance protects benefits if a plan sponsor cannot meet its obligations. The result is predictable income that behaves like a continuation of your paycheck after employment ends.

Why Lump Sum Rollovers Appeal to Engineers

Lump sum rollovers appeal to engineers because they appear efficient and flexible.

You see the full balance

You control investment decisions

You choose withdrawal timing

You can leave remaining assets to beneficiaries

That flexibility comes with responsibility. Once you take a lump sum rollover, you assume full responsibility for managing that money for the rest of your life. There is no automatic income guarantee and no correction mechanism if early decisions go wrong.

The Risk Most Engineers Underestimate

The most commonly overlooked risk is longevity.

Engineers often retire healthy and live well into their eighties. That increases the chance of outliving a lump sum if withdrawals exceed sustainable levels or markets underperform early in retirement.

A pension automatically adjusts for longevity. It pays as long as you live. A lump sum does not. Each withdrawal permanently reduces the balance. Once depleted, income stops.

Health and Survivor Planning

Health and family structure should play a central role in this decision.

If you expect a long retirement or want to protect a spouse who depends on your income, a pension often provides stronger baseline security. Joint and survivor options can deliver income for two lifetimes.

A lump sum may make sense if your spouse has strong independent income or if you already have substantial assets designed to support survivors. In those cases, flexibility may outweigh built in pension protection.

Investment Skill Is Not Static

Many engineers assume they will manage retirement assets with the same discipline they used during their careers. That assumption weakens over time.

Health changes

Risk tolerance shifts

Market stress becomes harder to manage

Decision fatigue increases

A pension requires no ongoing oversight. A lump sum requires constant monitoring, rebalancing, and withdrawal discipline. This difference becomes more important later in retirement, not less.

Tax Complexity Adds Risk

Taxes often influence outcomes more than expected.

Lump sum rollovers avoid immediate taxation only if executed correctly. Mandatory withholding applies to distributions taken directly. Early withdrawals may trigger penalties.

Even with a rollover, taxes still apply later when withdrawals begin. Required minimum distributions add another planning constraint.

Pension payments spread taxation over time. This simplifies planning and reduces the risk of costly errors.

Three Unseen Factors That Change the Decision

Most people never evaluate these three factors, yet they often determine which option performs better over a full retirement.

Factor 1: Interest Rates Matter

Interest rates directly affect lump sum calculations.

When rates are high, lump sums use higher discount rates. That lowers the present value of your payout. In many cases, this can reduce a lump sum by $50,000 or more compared to a lower rate environment.

Two Raytheon engineers with identical service histories can receive materially different lump sums based solely on retirement timing. The pension payment itself does not change based on interest rates. The lump sum does.

Factor 2: Inflation Risk

Many Raytheon pensions frozen in 2007 do not include cost of living adjustments.

That means the monthly payment stays fixed while expenses rise. Over 20 to 30 years, inflation steadily erodes purchasing power. What feels adequate at age 65 may feel constrained at age 80.

A pension protects against longevity risk but not inflation risk when payments remain level. A rollover introduces market risk but allows assets to grow and potentially offset inflation.

This tradeoff deserves careful evaluation.

Factor 3: Survivor Benefits Versus Flexibility

Pensions offer built in survivor protection. Joint and survivor options continue income to a spouse after death.

That protection has value, but it comes at a cost. Survivor elections reduce monthly payments.

If your spouse is a high earner or you hold significant assets elsewhere, that protection may not justify giving up rollover flexibility.

Federal pension insurance through the Pension Benefit Guaranty Corporation backstops many private sector pensions, but only up to annual limits. Benefits above roughly $75,000 per year may not be fully protected.

This matters for higher benefit Raytheon engineers and should factor into the decision.

When a Lump Sum Rollover May Be Appropriate

A lump sum rollover may be appropriate if:

You already have guaranteed income covering essential expenses

You understand market and withdrawal risk

You plan conservatively for long term income

You accept income variability tied to markets

For many Raytheon engineers, the pension already delivers what retirement requires most.

Reliable income

Lower stress

Protection against living longer than expected

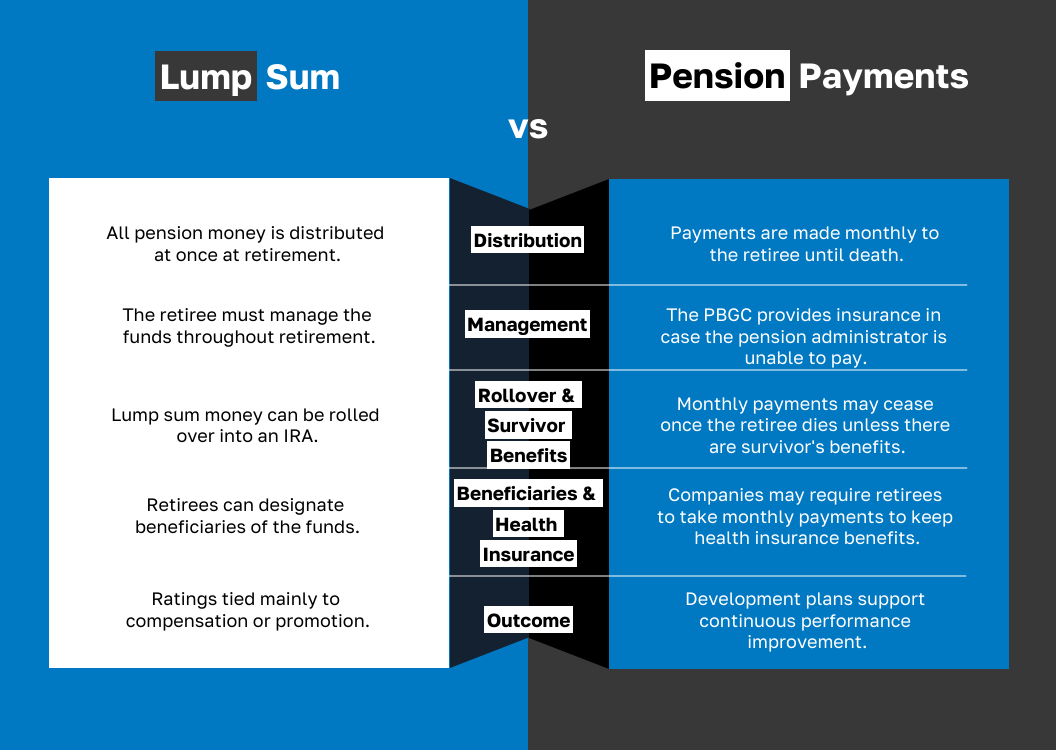

Key Differences Between a Lump Sum Rollover and Pension Payments

How ONE Advisory Partners Can Help

The pension or lump sum rollover decision affects more than just income. It influences taxes, required minimum distributions, investment strategy, and long term retirement stability. Making this choice without coordinated guidance can introduce risk that compounds over time.

Jeffrey Davis AAMS® helps you evaluate pension and rollover options within the context of your full financial picture at ONE Advisory Partners. He helps you compare scenarios, understand tax and income tradeoffs, and choose an approach that supports steady retirement income with fewer surprises, aligned with the lifestyle and future you want to protect.

Bottom Line

For Raytheon engineers, the pension versus lump sum rollover decision is not about which option looks larger today. It is about how risk shifts over time. A pension reduces market and longevity risk but may expose you to inflation risk and benefit limits. A lump sum increases flexibility but places investment, withdrawal, and longevity risk on you.

Interest rates, inflation, and survivor needs often matter more than balance size. This decision happens once, but the consequences last for decades. The right choice is the one that holds up when markets change, inflation compounds, and retirement stretches longer than expected.

Frequently Asked Questions About Pension and Lump Sum Retirement Payouts

How does the Raytheon pension work at retirement

The Raytheon pension pays a fixed monthly income for life based on years of service and earnings history. Many plans also offer survivor benefit options that continue income to a spouse.

Are Raytheon pensions adjusted for inflation

Many Raytheon pensions frozen in 2007 do not include cost of living adjustments. The monthly payment stays the same while inflation reduces purchasing power over time.

How do interest rates affect Raytheon lump sum rollovers

Higher interest rates reduce lump sum values because the calculation uses higher discount rates. Two Raytheon engineers with identical service histories can receive very different lump sums depending on retirement timing.

Is a lump sum rollover safer than a Raytheon pension

A lump sum rollover provides flexibility but shifts investment, withdrawal, and longevity risk to you. A Raytheon pension provides lifetime income and removes those risks but may expose you to inflation risk.

Should Raytheon engineers choose survivor benefits or a lump sum rollover

Survivor benefits provide lifetime income for a spouse but reduce monthly payments. A lump sum rollover may offer more flexibility if your spouse has strong independent income or you hold substantial assets elsewhere.

When does a lump sum rollover make sense for Raytheon engineers

A lump sum rollover may make sense if you already have guaranteed income covering essential expenses, understand market and withdrawal risk, and are comfortable managing retirement assets long term.

When does choosing a lump sum make sense

A lump sum may make sense if you already have enough guaranteed income to cover living expenses, understand investment and withdrawal risks, and are comfortable managing money for the rest of your life.

Reference

Consumer Financial Protection Bureau. (2016). Pension lump sum payouts and your retirement security. Retrieved from https://files.consumerfinance.gov/f/201601_cfpb_pension-lump-sum-payouts-and-your-retirement-security.pdf

Investopedia Staff. (2025). Lump sum vs. pension payments: What’s the difference. Retrieved from https://www.investopedia.com/articles/retirement/05/lumpsumpension.asp

Pension Benefit Guaranty Corporation. (2024). Understanding pensions. Retrieved from https://www.pbgc.gov/workers-retirees/new/understanding-pensions

Internal Revenue Service. (2024). Tax topic no. 410: Pensions and annuities. Retrieved from https://www.irs.gov/taxtopics/tc410

Wells Fargo Private Bank. (2024). SECURE Act 2.0: What you need to know about new retirement savings and distribution rules. Retrieved from https://www.wellsfargo.com/the-private-bank/insights/apu-secure-act