Roth Catch-Ups Are Changing in 2026

If you are over 50 and earn more than $150,000, your retirement savings rules may be changing. Starting January 1, 2026, many high earners will be required to make catch-up contributions as Roth instead of pre-tax.

This change, created under SECURE Act 2.0, affects how much tax you pay now and how your retirement income is taxed later. If you rely on catch-up contributions to reduce taxable income, it is important to understand what is changing and how to prepare.

What Are Catch-Up Contributions

Catch-up contributions allow people aged 50 and older to save more than the standard annual retirement limit.

They apply to:

401k plans

403b plans

457 plans

IRAs

SIMPLE IRAs

The idea is simple. If you are closer to retirement, the IRS lets you save more each year to help you catch-up.

In 2025, the standard 401k limit was$23,500. If you are 50 or older, you couldadd another $7,500 as a catch-up contribution. That brings your total to $31,000.

In 2026, the limits rise again. The standard 401k limit will go to $24,500. If you are age 50 or older, and your plan allows for catch-ups, you can add at least another $8,000 as a catch-up contribution. If ages 60 to 63 and your plan allows, your catch-up may be as much as $11,250 for 2026.

Download Your Free Guide Here

What Changes in 2026

Beginning January 1, 2026, a new rule takes effect.

If you earned more than $150,000 in FICA wages (i.e. typically, wages reported on a Form W-2) in the prior year, your catch-up contributions must be made as Roth contributions.

That means:

No tax deduction on the catch-up portion

Contributions are made with after tax dollars

Future qualified withdrawals may betax free

This rule applies only to catch-up contributions. Your regular 401k deferral can still be pre-tax if you choose.

The income test is based on prior year wages shown in Box 3 of your W 2. The threshold will be indexed for inflation over time.

Who This Impacts Most

This change primarily affects:

Professionals earning over $150,000

Executives and business owners

Physicians and attorneys

Engineers and senior managers

Anyone age 50 or older using catch-up contributions

Roughly 3.5 million workers fall into this category based on IRS estimates.

If you are close to retirement and using catch-ups to reduce your tax bill, this change matters.

What Stays the Same

A few things are not changing.

The base 401k contribution limit still allows pre-tax contributions

IRAs are not subject to the Roth catch-up rule

Roth IRAs still follow income limits

The rule only applies to employer plans

If your employer does not offer a Roth 401k option, you may not be able to make catch-up contributions at all unless your plan updates its structure.

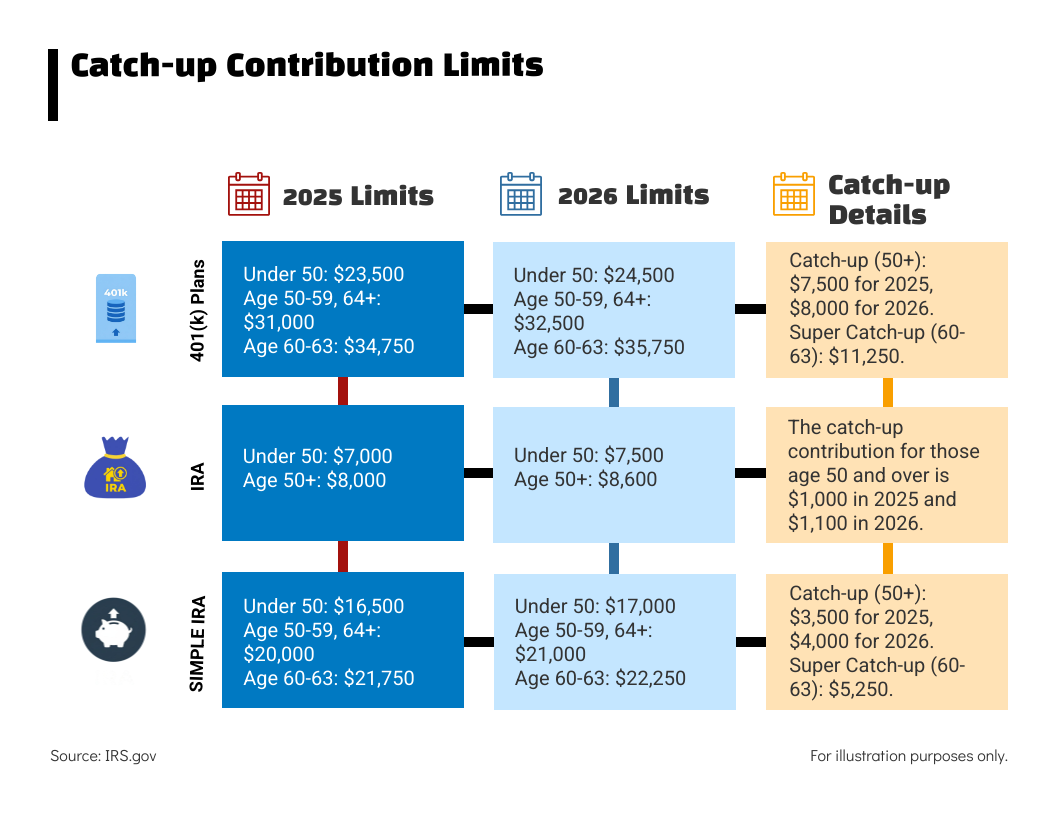

2025 and 2026 Contribution Limits

Here is a simplified look at the numbers.

2025 401k Limits

Under 50: $23,500

Age 50 and over: $31,000 (includes the catch-up amount of $7,500)

Ages 60 to 63 may contribute even more under the super catch-up rule

2026 401k Limits

Under 50: $24,500

Age 50 and over: $32,500 (includes the catch-up amount of $8,000)

Ages 60 to 63 may contribute even more under the super catch-up rule

If you earned more than $150,000 in FICA wages in 2025, then the$8,000 (or more) catch-up must go into Roth starting in 2026.

Why This Matters for Taxes

Pre-tax contributions reduce taxable income today. Roth contributions do not.

That means higher earners will likely see:

Higher taxable income

Larger tax bills

Less flexibility for tax planning

Potential phase outs for deductions or credits

For someone in a high tax bracket, losing the deduction on an $8,000 contribution can mean several thousand dollars in additional taxes each year.

At the same time, Roth money grows tax free and does not require required minimum distributions later. That can be valuable in retirement.

The challenge is timing and cash flow.

What If Your Plan Does Not Offer a Roth Option

Some plans still do not support Roth 401k contributions. If that is the case, your options may include:

Roth IRA Contributions

If your income allows, you can contribute directly to a Roth IRA.

Backdoor Roth Strategy

If your income is too high, you may be able to use a backdoor Roth conversion. This requires careful planning due to IRS pro rata rules.

Adjusting Other Contributions

Some investors reduce or pause other Roth conversions to offset the added taxable income from Roth catch-ups.

Tax Planning Adjustments

You may need to increase withholding or quarterly payments to avoid underpayment penalties.

What You Should Do Now

If you are over 50 and earning near or above the threshold, planning now matters.

Start with these steps early in 2026:

Review your 2025 income

Confirm whether your plan offers Roth contributions

Estimate the tax impact of losing the deduction

Review your broader tax and retirement strategy

Coordinate with your advisor before year end

Waiting until later in 2026 may limit your options.

Download Your Free Guide Here

Why This Change Exists

SECURE Act 2.0 was designed to increase long-term retirement savings and tax revenue.

Lawmakers want more retirement dollars flowing into Roth accounts to generate more tax revenue now, but with the potential benefit that future withdrawals may betax free.

For savers, this creates both opportunity and complexity.

Download Your Free Guide Here

How One Advisory Partners Helps You

The new Roth catch up rules make retirement planning more complex for high earners. Losing the ability to deduct catch up contributions can affect cash flow, tax brackets, and long-term strategy. That is where informed planning matters most.

Jonathan Booze J.D., CFP®, AIF® helps high income professionals evaluate how these changes fit into their broader financial picture. He works with clients to coordinate pre tax and Roth savings, adjust contribution strategies, and plan for the tax impact of SECURE Act 2.0. His background in law, executive compensation, and retirement planning allows him to spot issues that are often missed when rules change.

If you are over 50 and earning above the Roth catch up threshold, now is the time to review your plan. A thoughtful strategy can help you manage taxes today while keeping your long-term retirement goals on track.

The Bottom Line

Catch-up contributions remain one of the most powerful retirement tools available. That does not change.

What does change is how they are taxed for high earners starting in 2026.

If you earn over $150,000 and plan to use catch-up contributions, your strategy may need to adjust. The earlier you plan, the more control you keep over your taxes and long-term outcomes.

Working with a professional who understands these rules can help you avoid surprises and make smarter decisions with your retirement savings.

Frequently Asked Questions About Roth catch-up Rules

What is a catch-up contribution

A catch-up contribution allows people age 50 and older to contribute more than the standard IRS limit to retirement accounts.

When does the Roth catch-up rule start

The rule begins January 1, 2026.

Who must use Roth catch-up contributions

Anyone age 50 or older who earned more than $150,000 in FICA wages from the same employer in the prior year.

Does this apply to IRAs

No. The Roth catch-up rule only applies to employer sponsored plans like 401k and 403b plans.

Can I still make pre-tax contributions

Yes. The base contribution can still be pre-tax. Only the catch-up portion must be Roth.

What if my employer does not offer a Roth option

You may be unable to make catch-up contributions until your plan adds Roth support.

Does this increase my taxes

Yes. You lose the exclusion on the catch-up portion, which increases taxable income.

Is the Roth option bad

Not necessarily. Roth accounts offer tax free growth and withdrawals, which can be valuable later in retirement.

Should I change my strategy now

If you are near the income threshold or age 50, reviewing your plan as soon as possible in 2026 is wise.

Reference

Internal Revenue Service. (n.d.). Retirement topics: Beneficiary. Retrieved from

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary

Internal Revenue Service. (2025). 401(k) limit increases to $24,500 for 2026; IRA limit increases to $7,500. Retrieved from

https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

Internal Revenue Service. (n.d.). Retirement topics: Catch-up contributions. Retrieved from

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-catch-up-contributions

Federal Register. (2025). Catch-up contributions. Retrieved from

https://www.federalregister.gov/documents/2025/09/16/2025-17865/catch-up-contributions

Charles Schwab. (n.d.). What to know about catch-up contributions. Retrieved from

https://www.schwab.com/learn/story/what-to-know-about-catch-up-contributions