The Social Security Benefit Most Divorced Spouses Miss

If you are divorced, you may have access to divorced spouse Social Security benefits that can strengthen your retirement income. Many people miss this because they assume divorce ends every financial tie. It does not. In fact, if you meet a few rules, you can claim a benefit based on your ex-spouse’s work history and increase your lifetime income significantly.

This can add thousands or even six figures to your retirement over time. The Social Security Administration created this rule for a reason. Your financial future should not depend on staying married. So if you qualify, claim it without hesitation.

Let’s break it down.

DOWNLOAD YOUR FREE GUIDE HERE

The Basic Eligibility Rules

Your eligibility comes down to three main requirements.

You must:

Social Security Eligibility

Have been married to your ex for at least 10 years

Be at least age 62

Be currently unmarried

These rules apply no matter how long ago you divorced. Even if your ex has already remarried, you can still claim. Their current spouse can also claim. None of this affects your benefit.

Your ex also does not need to be receiving their own benefits for you to qualify. If you have been divorced for at least two continuous years and your ex is eligible to claim, you can request your benefit even if they have not filed. This keeps the process simple and private. Your ex will not be notified when you apply.

How Much You Can Receive

If you qualify, you can receive up to 50 percent of your ex-spouse’s full retirement benefit. This does not reduce their benefit. It is simply a separate amount available to you.

If your ex has passed away, the rules become even more helpful. You may qualify for up to 100 percent of their benefit as a survivor. If you claim at full retirement age, you receive the full survivor benefit your late spouse was entitled to receive.

If you claim early, your benefit will be permanently reduced. The earliest you can file for a divorced spouse benefit is age 62. The earliest you can file for a survivor benefit is age 60.

DOWNLOAD YOUR FREE GUIDE HERE

What Happens if You Have Your Own Work Record

If you qualify for your own retirement benefit, Social Security will pay that first. Then they will compare it to the amount you are entitled to on your ex-spouse’s record.

If the divorced spouse benefit is higher, Social Security will add the difference so that your total equals the larger benefit. You never receive both amounts in full. You receive whichever benefit is higher, with Social Security adding the difference if needed.

There is one exception. If you were born before January 2, 1954 and you file at full retirement age, you can choose to claim only the divorced spouse benefit while allowing your own benefit to grow. This strategy is no longer available for anyone born on or after that date.

What Happens if You Continue Working

If you are still working and claim before reaching full retirement age, the earnings limit applies. Your income can reduce your payments for that year. Social Security uses an earnings test to calculate this. After you reach full retirement age, the limit no longer applies.

The 10 Year Marriage Rule Explained

The 10 year marriage rule is non-negotiable. If you were married for nine years and eleven months, you do not qualify.

If you were married more than once and each marriage lasted at least 10 years, Social Security will compare the benefits available from each former spouse. You can receive only one benefit, not both, so they will give you the larger amount.

If your ex remarried, it does not affect you. If you remarry, it does. If you remarry while your former spouse is still alive, you lose access to divorced spouse benefits. However, if your ex passes away, you can remarry at age 60 or older and still keep survivor benefits based on their record.

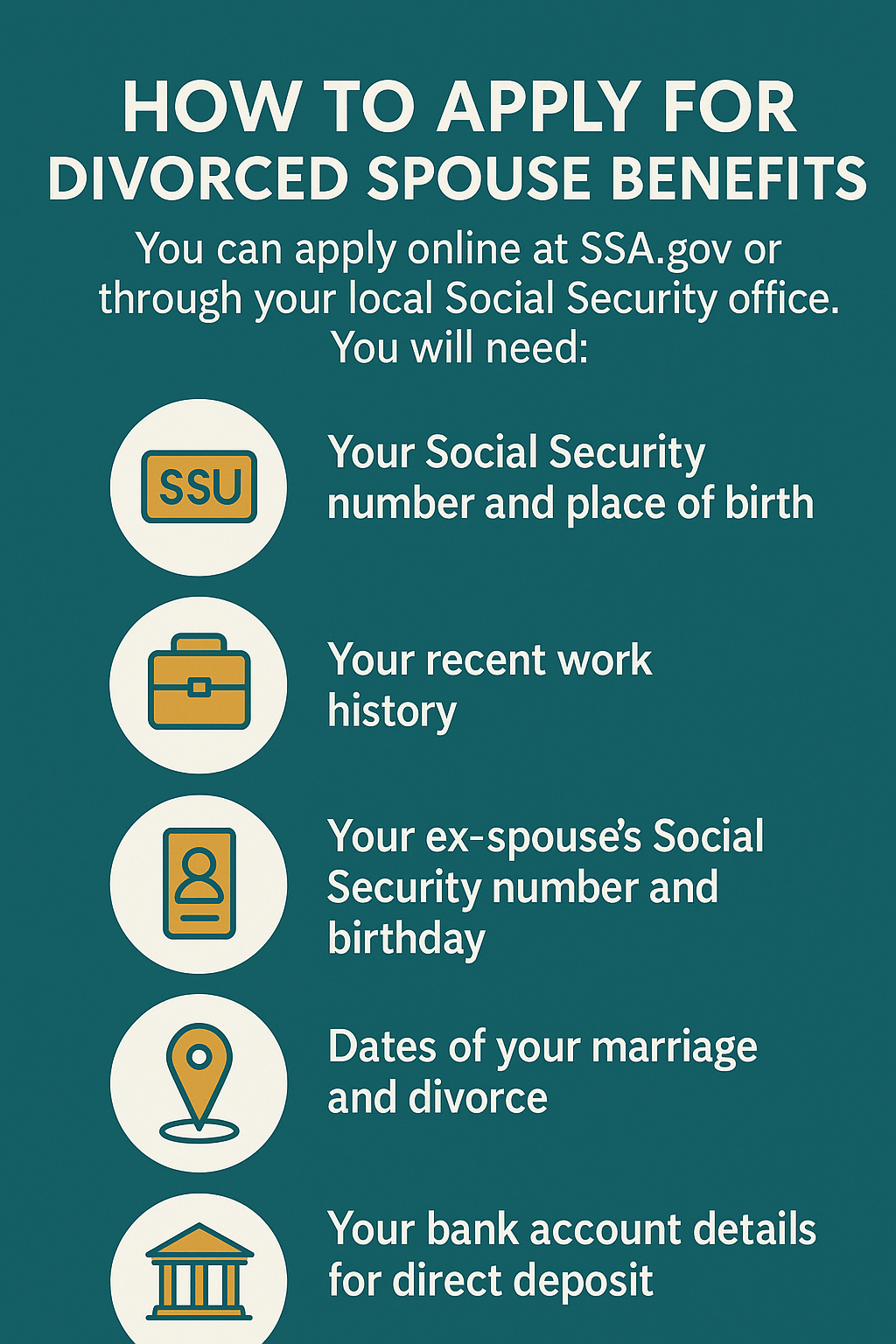

How to Apply for Divorced Spouse Benefits

You can apply online at SSA.gov or through your local Social Security office. You will need:

How to apply for Divorced Spouse Benefits

Your Social Security number and place of birth

Your recent work history

Your ex-spouse’s Social Security number and birthday

Dates of your marriage and divorce

The city, state, and country where you married

Your bank account details for direct deposit

When you apply, Social Security automatically checks both your record and your ex-spouse’s record. They pay your benefit first. Then they add any amount needed to match the higher divorced spouse benefit.

The process is straightforward. You do not need your ex-spouse’s permission. They will not receive a notice, and it will not reduce anything they are entitled to receive.

Why This Matters for Your Retirement Plan

Many divorced adults leave money on the table because they assume they do not qualify or they feel uncomfortable claiming based on an ex-spouse’s work history. The truth is that this benefit exists to protect your retirement. You earned it through the years you were married and through your ex-spouse’s contributions to Social Security.

This benefit can do several things for you:

Increase your monthly income

Allow you to delay claiming your own benefit so it can grow

Provide full survivor benefits if your ex passes away

Add tens of thousands in lifetime benefits

The financial impact can be significant. For many people, the divorced spouse or survivor benefit is the difference between a tight retirement and a secure one.

DOWNLOAD YOUR FREE GUIDE HERE

How One Advisory Partners Helps You

Social Security decisions can feel complicated, especially when divorce or the loss of a spouse is part of your retirement picture. One Advisory Partners helps you understand your options so you can make confident choices that support your long term financial plan.

You also get personal planning support. Your fiduciary advisor reviews your income needs, investment strategy, tax considerations, and future goals, then builds a retirement plan that includes the best use of Social Security.

You do not need to figure these rules out alone. One Advisory Partners helps you understand the numbers, compare scenarios, and choose the path that gives you the most stable retirement income.

If you’d like support through major life changes like divorce, estate planning, or loss of a spouse or partner, reach out to connect with Christel Turkiewicz, CRPC®, CDFA®. She offers thoughtful guidance from Mooresville, NC (serving clients nationwide) and brings over 30 years of experience in wealth management and financial education.

Schedule a conversation with Christel

Bottom Line

Divorce does not end your access to Social Security benefits tied to your former spouse. If your marriage lasted at least 10 years and you meet the age and marital status requirements, you can claim a divorced spouse benefit that may be higher than what you would receive on your own record. If your ex has passed away, you may qualify for a survivor benefit of up to 100 percent.

If you are unsure which option pays more, start the application. Social Security will calculate it for you and give you the higher amount. This benefit can play an important role in your retirement income, so take full advantage of it.

FAQs: Divorced-Spouse Social Security Benefits

When am I eligible for a divorced-spouse benefit?

You must have been married at least 10 years, be at least age 62, be unmarried at the time you claim, and your ex-spouse must be entitled to Social Security retirement benefits.

What documents will I need when I apply?

You’ll likely need your Social Security number and place of birth, your recent work history, your ex-spouse’s Social Security number and birthday, dates of your marriage and divorce, the city,state,country of your marriage, and your bank account details for direct deposit.

How much can I receive?

If you claim at your full retirement age and meet all conditions, you may receive up to 50 % of your ex-spouse’s full retirement benefit from their record.

Does claiming on my ex-spouse’s record reduce their benefit?

No. Claiming based on your ex-spouse’s record does not reduce what they or their current spouse receive.

What if my ex-spouse has died?

You may be eligible for a survivor benefit based on your ex-spouse’s record (often up to 100 % of their benefit) if you meet the eligibility rules.

Why is this benefit important for your retirement plan?

This benefit can increase your monthly income, allow you to delay claiming your own benefit, and potentially add tens of thousands of dollars in lifetime benefits—especially if your own work history produced a lower benefit than your ex-spouse’s.

How does the claiming age affect the amount I get?

If you claim before your full retirement age, the benefit from your ex-spouse’s record is reduced permanently (for example to roughly 32.5 % if you claim at age 62 instead of the full 50 %).

Reference

Social Security Administration. (n.d.). Divorced spousal beneficiaries in 2050. Retrieved from https://www.ssa.gov/policy/docs/projections/populations/divorced-spousal-2050.html ssa.gov

Investopedia. (n.d.). Divorced spouse Social Security benefits: eligibility & how to claim. Retrieved from https://www.investopedia.com/ask/answers/081815/can-divorced-woman-collect-social-security-her-exhusband.asp Investopedia

AARP. (n.d.). Divorce and Social Security spousal benefits. Retrieved from https://www.aarp.org/social-security/retirement/spousal-benefits/