How Social Security Works After Your Spouse Dies

Losing a spouse changes everything, including your finances. Social Security survivor benefits often become a primary income source, yet the rules are rarely clear. The amount you receive, when you claim, and which benefit you choose can shape your income for the rest of your life. Read on to understand how survivor benefits work, what choices you have, and how timing affects long-term outcomes.

Who Qualifies For Social Security Survivor Benefits

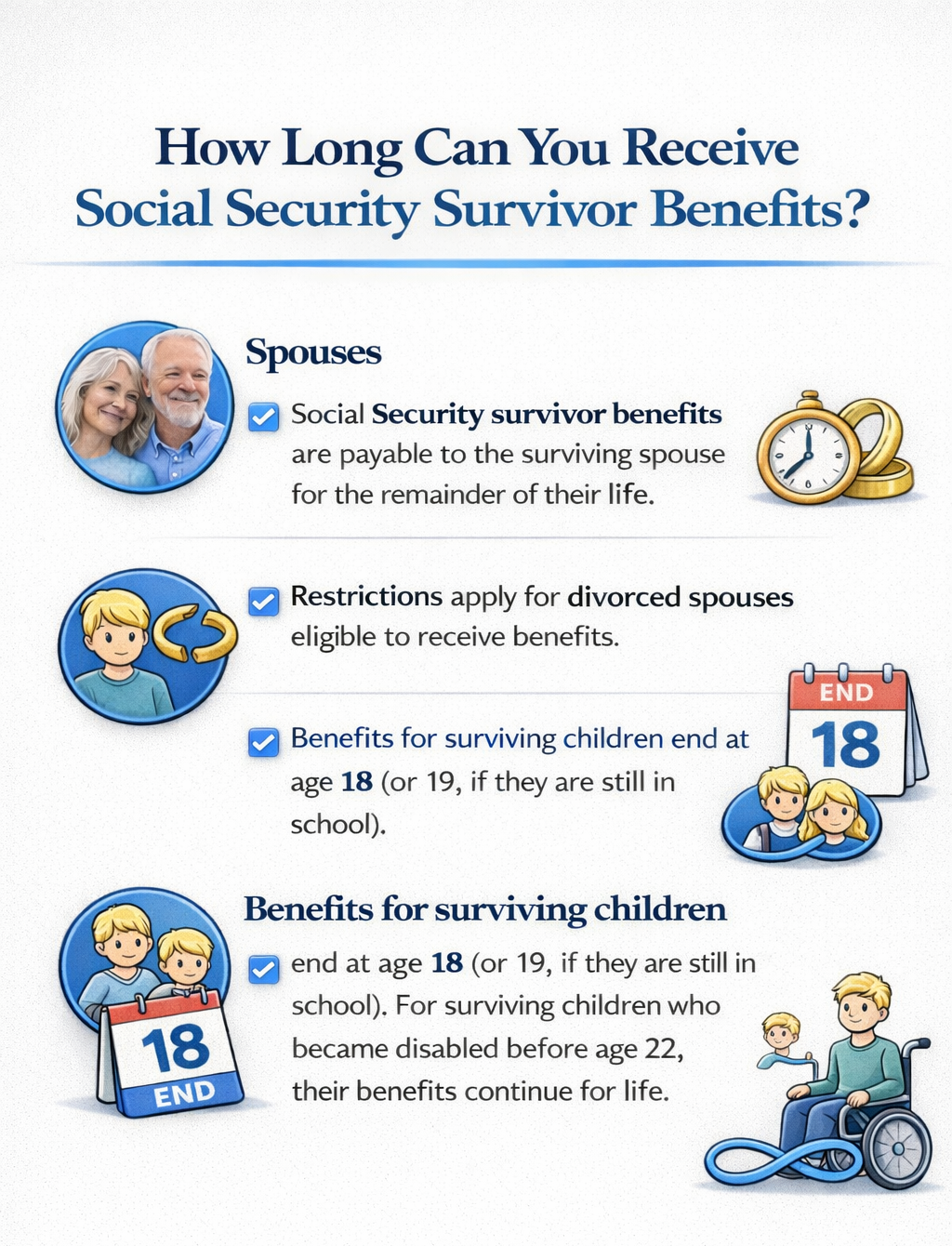

You may qualify for survivor benefits as a spouse, divorced spouse, child, or dependent parent. Most surviving spouses become eligible at age 60. If you have a disability, eligibility can begin as early as age 50. If you are caring for your deceased spouse’s child who is under age 16 or has a disability, you may qualify at any age.

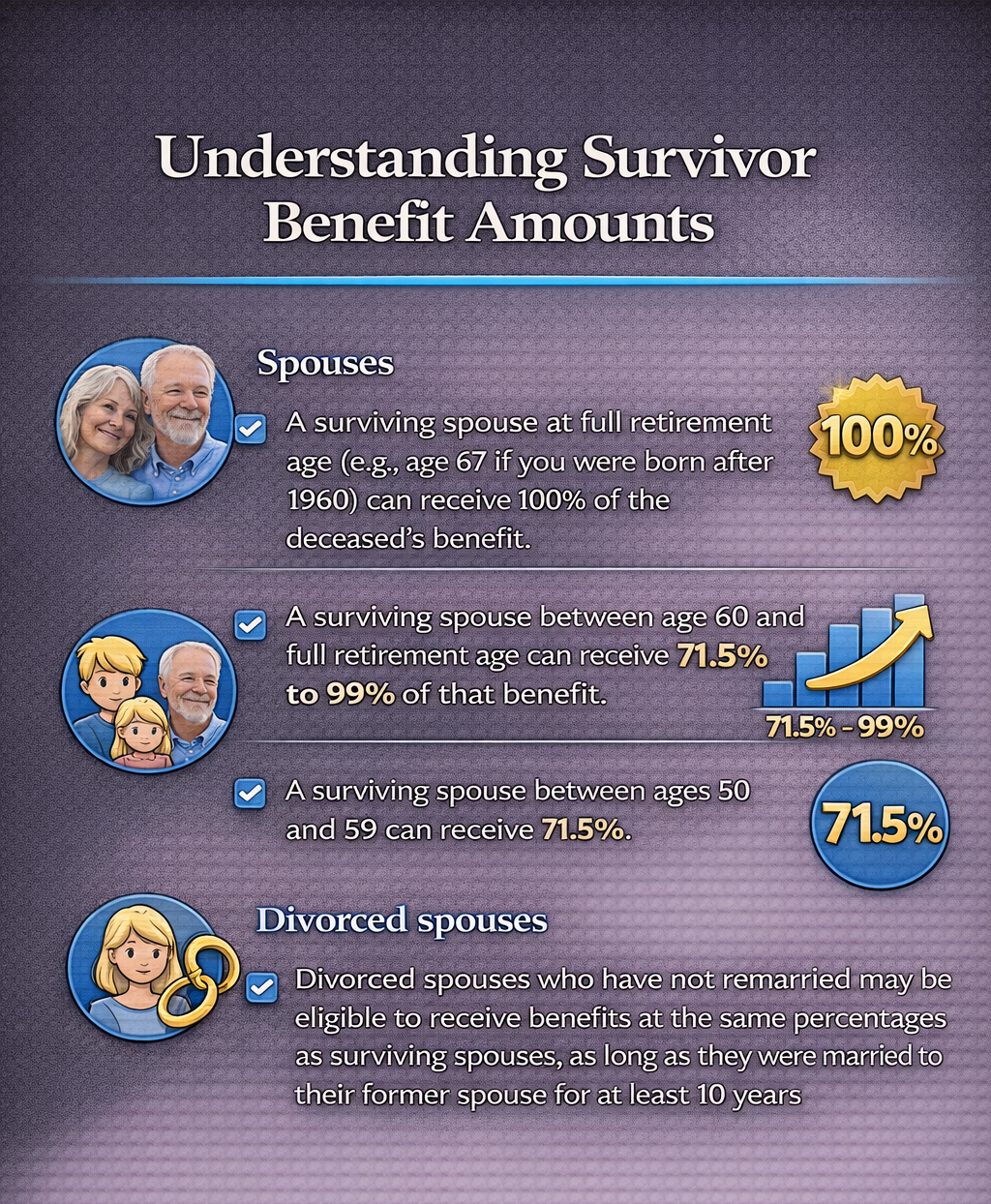

Divorced spouses can also qualify. If the marriage lasted at least 10 years and you meet the age requirements, you may claim survivor benefits even if your former spouse remarried. Remarriage before age 60 generally removes eligibility, but remarriage after age 60 does not.

Download Financial Life After a Life Transition

How Much You Can Receive As A Surviving Spouse

Survivor benefits are based on your late spouse’s work record. If you reach your full retirement age for survivor benefits, you can receive up to 100% of what your spouse was receiving or was entitled to receive. This is not a reduced benefit. It replaces the prior payment.

If you claim earlier, the amount is lower. Benefits start at about 71.5% at age 60 and increase each year you wait. The closer you get to full retirement age, the higher the % age becomes. Once you claim, that decision stays with you for life.

Choosing Between Your Own Benefit And A Survivor Benefit

You do not receive both your own Social Security benefit and a survivor benefit. Social Security pays the higher of the two. This rule applies even if you already qualify for retirement benefits on your own work record.

What many people miss is that you can switch later. You may start with survivor benefits and delay your own retirement benefit until age 70, when your personal benefit is highest. Or you may claim your own benefit first and later switch to a higher survivor benefit. This flexibility creates real planning opportunities.

When Claiming Early Makes Sense And When It Does Not

You can claim survivor benefits as early as age 60, but early claiming permanently reduces your monthly income. The reduction may feel manageable at first, but it compounds over decades. This choice affects every future payment.

Early claiming may still make sense in certain situations. Cash flow needs, health concerns, or employment changes may push timing forward. The key is understanding the tradeoff before filing. Survivor benefit decisions cannot be undone.

Download Financial Life After a Life Transition

What Happens If You Are Still Working

If you work while receiving survivor benefits and you are under full retirement age, an earnings limit applies. If your earnings exceed the annual limit, Social Security temporarily reduces your benefit. Once you reach full retirement age, this limit disappears.

Only your own benefit is affected by your earnings. Other family members receiving benefits on the same record are not impacted. This distinction matters when multiple survivors rely on the same work history.

Benefits For Children And Family Maximum Rules

Children may qualify for survivor benefits equal to 75% of the deceased parent’s benefit. Eligibility generally applies until age 18, or age 19 if still in school. Children with disabilities that began before age 22 may qualify at any age.

There is also a family maximum. Social Security limits how much a family can receive each month, typically between 150% and 180% of the worker’s benefit. If payments exceed that cap, benefits are reduced proportionally. Divorced spouses do not count toward this limit.

The One Time Lump Sum Death Payment

Social Security provides a one time lump sum death payment of $255. This payment goes to an eligible spouse or qualifying child. Survivors must apply within two years of the date of death.

This payment is small, but it often surprises families who did not know it existed. It does not replace monthly benefits and does not require long-term eligibility. It simply requires timely action.

How And When To Apply For Survivor Benefits

You cannot apply for survivor benefits online. You must apply by phone or at a Social Security office. If you were already receiving spousal benefits, Social Security often converts them automatically to survivor benefits once the death is reported.

If you were receiving benefits based on your own work record, you must contact Social Security to determine if a survivor benefit would pay more. Do not delay applying while gathering paperwork. Social Security allows applications to move forward as documents are collected.

Why Survivor Benefit Timing Deserves Planning

Survivor benefits involve more than paperwork. They shape your income for decades. The choice of when to claim, which benefit to use first, and how employment fits into the picture all interact.

Many survivors default into decisions without realizing options exist. Understanding survivor benefits early allows you to protect income, preserve flexibility, and avoid permanent reductions that cannot be fixed later.

How ONE Advisory Partners Helps

Navigating survivor benefits rarely happens in isolation. Social Security decisions affect taxes, cash flow, Medicare timing, and long-term income planning. Christel Turkiewicz, CRPC®, CDFA®, works with widows and divorcees to align survivor benefits with the rest of their financial life, not just the filing decision.

At ONE Advisory Partners, the focus is on sequencing. When to claim survivor benefits. When to delay retirement benefits. How employment, taxes, and future income sources interact. The goal is clarity and confidence so decisions support your long-term stability, not just the next payment.

Bottom Line

Social Security survivor benefits provide meaningful income, but the rules are complex and the decisions are permanent. Timing matters. Benefit choice matters. Small missteps can reduce income for life.

Understanding your options before you file gives you leverage at a time when control feels limited. Survivor benefits work best when they fit into a broader plan, not when they are handled in isolation.

Frequently Asked Questions About Social Security Survivor Benefits

Can I receive survivor benefits and my own retirement benefit at the same time

No. Social Security does not stack benefits. You receive the higher of the two. You may switch between benefits later if it improves your income.

Do survivor benefits stop if I remarry

Remarriage before age 60 generally ends eligibility for survivor benefits. Remarriage at age 60 or later does not affect your ability to receive benefits based on a former spouse’s work record.

Do I need to have worked to receive survivor benefits

No. Survivor benefits are based on your late spouse’s work record. You may qualify even if you never earned enough credits on your own. If you do qualify for your own benefit, Social Security pays the higher amount.

Will working reduce my survivor benefit

If you are under full retirement age and earn above the annual earnings limit, Social Security may temporarily reduce your benefit. Once you reach full retirement age, earnings no longer reduce survivor benefits.

Reference

Social Security Administration. (n.d.). Survivor Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10084.pdf

Social Security Administration. (n.d.). Survivor benefits amount. Retrieved from https://www.ssa.gov/survivor/amount

AARP. (n.d.). When a spouse dies Social Security FAQ. Retrieved from https://www.aarp.org/social-security/faq/when-spouse-dies//#:~:text=When%20a%20Social%20Security%20beneficiary,appointment%20to%20file%20your%20claim.

Social Security Administration. (2025, May 29). Social Security blog. Retrieved from https://www.ssa.gov/blog/en/posts/2025-05-29.html