Should I Pay Off My Mortgage With Rental Sale Proceeds?

Selling a rental property often creates a moment of choice. You suddenly have cash and a big decision to make. Paying off your mortgage sounds simple and satisfying, but it is not always the best move. This article helps you think through the tradeoffs so you can decide what fits your finances and your peace of mind.

Start With the Numbers but Do Not Stop There

The first step is comparing your mortgage interest rate to what you could earn by investing the proceeds after taxes. If your mortgage costs 6% and your realistic after tax investment return is lower, paying off the loan may look appealing.

But investment returns are not guaranteed. Markets fluctuate, taxes reduce results, and timing matters. The numbers matter, but they do not tell the full story on their own.

Why Flexibility Often Matters More Than Returns

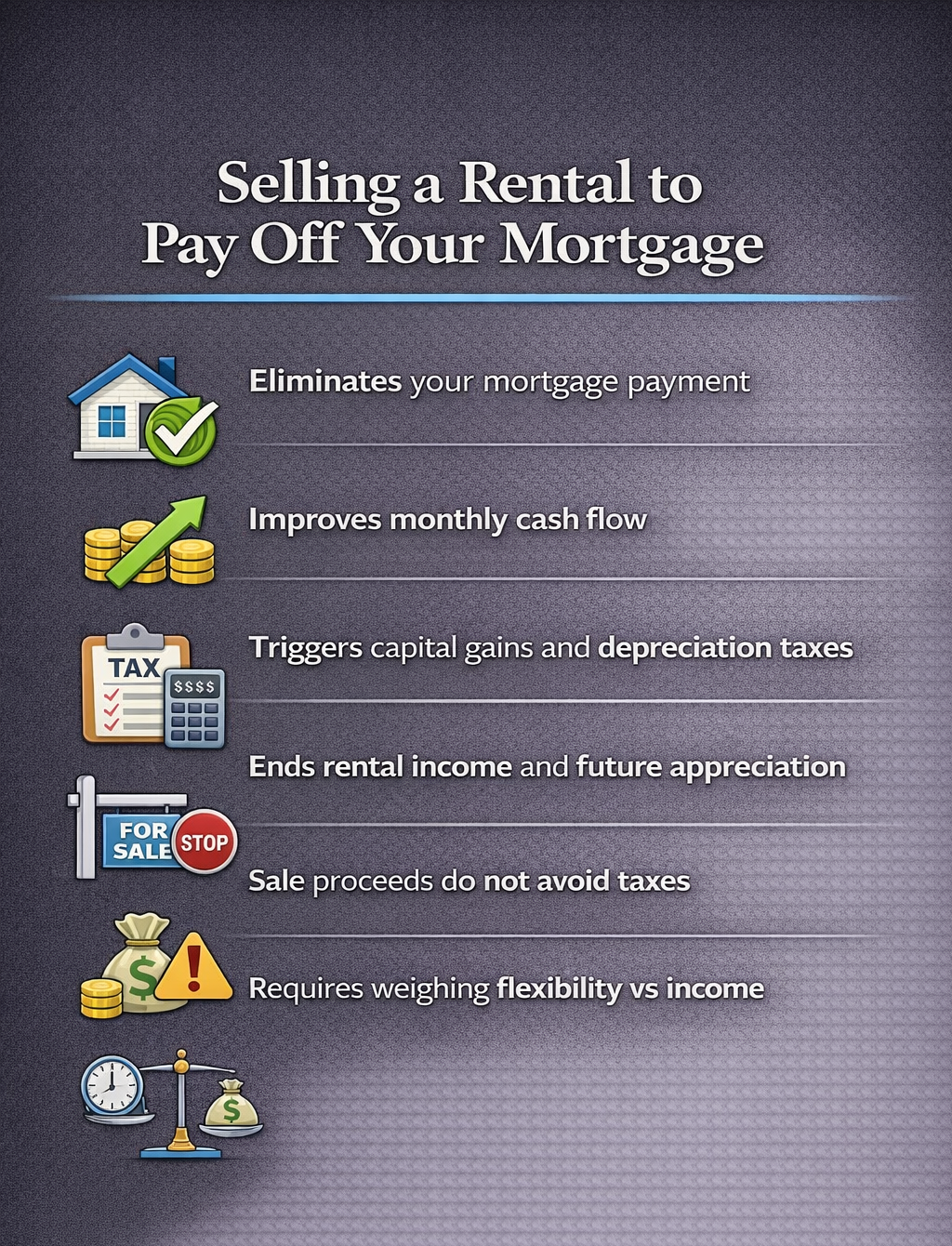

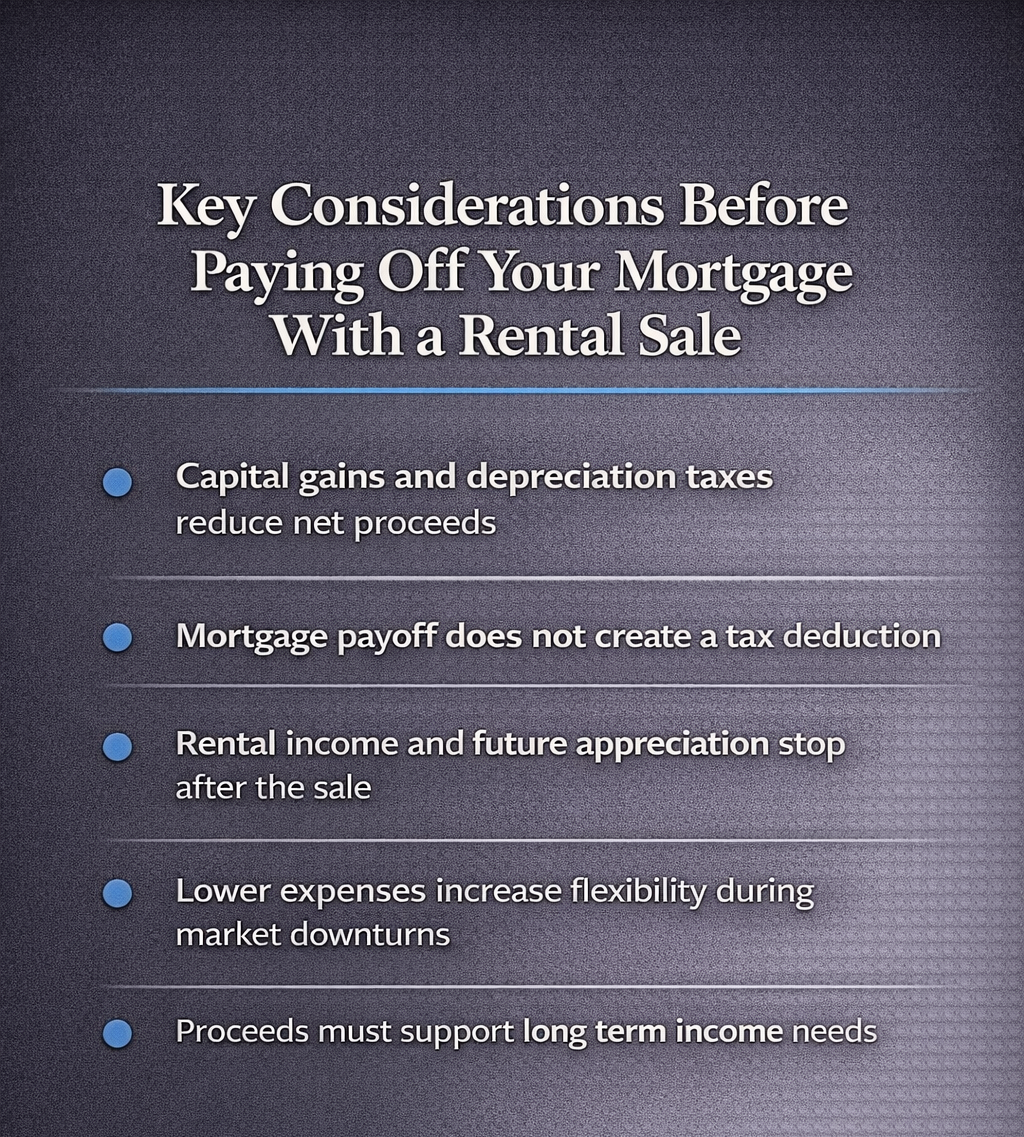

Paying off your mortgage reduces your required monthly income. That flexibility becomes valuable during market downturns or income disruptions. When expenses are lower, you can pull less from investments and avoid selling at the wrong time.

This matters most in retirement. Lower fixed expenses can support a lower withdrawal rate, which helps your portfolio last longer through both good and bad markets.

What You Give Up When You Sell a Rental

Selling a rental property means giving up future rental income and potential appreciation. If the property produces strong cash flow, that income may help cover living expenses or support retirement withdrawals.

On the other hand, rentals come with work. Repairs, vacancies, insurance increases, and tenant issues add stress. If the property feels like a burden rather than an asset, selling may improve both finances and quality of life.

Get Your Free Guide to Real Estate Exit Strategies

Taxes Can Quietly Change the Outcome

Rental property sales often trigger capital gains tax and depreciation recapture. Selling costs like commissions and closing fees further reduce what you actually receive.

This means the net proceeds matter more than the sale price. Before deciding, it helps to understand how much cash you will truly have available after taxes and expenses.

The Role of Your Mortgage Rate

A low fixed mortgage rate can be valuable. If your rate is well below conservative investment returns, keeping the mortgage may make sense from a math standpoint.

However, this assumes discipline. The proceeds need to stay invested long term. If the cash ends up sitting idle or slowly spent, the advantage disappears.

Debt-Free Living and Retirement Simplicity

Many people underestimate the emotional relief of having no mortgage. Lower stress often leads to better financial behavior, especially during volatile markets.

Without a mortgage payment, retirees often feel more confident adjusting spending and staying invested during downturns. That emotional stability can quietly improve long term outcomes.

When Paying Off the Mortgage Often Makes Sense

Using rental sale proceeds to pay off your mortgage may be a good fit if you are nearing retirement, value simplicity, or want to reduce required withdrawals. It can also make sense if your mortgage rate is high or the rental causes ongoing stress.

In these cases, the benefit is not just interest savings. It is control, flexibility, and fewer financial pressure points.

When Keeping the Mortgage May Be Smarter

Keeping the mortgage may work better if your rate is low, you have strong cash flow, and you are comfortable with market volatility. It can also make sense if the rental income plays a key role in your long term plan.

This approach requires patience and consistency. The strategy only works if the proceeds are invested thoughtfully and left alone.

This Is Not an All or Nothing Choice

Some homeowners choose a middle ground. They may pay down part of the mortgage to reduce payments while investing the rest for growth and liquidity.

The best decision balances numbers with behavior. A plan you can stick with usually beats a perfect plan you abandon.

The Question That Matters Most

Instead of asking how to maximize returns, ask how to maximize flexibility. The goal is not just growing money but using it well when conditions change.

The right answer is the one that supports steady decisions, lower stress, and long term sustainability.

How ONE Advisory Partners Helps You

Deciding whether to pay off your mortgage with rental sale proceeds is about more than interest rates. It affects taxes, cash flow, and how much flexibility your portfolio has over time. William Snider helps you evaluate the tradeoffs clearly so the decision supports your retirement income plan, not just the math.

At ONE Advisory Partners, the focus is on how each choice fits into your broader strategy. William works with clients nationwide to assess tax impact, reinvestment options, and long term income sustainability so you can move forward with confidence.

Book a call with William Snider.

Get Your Free Guide to Real Estate Exit Strategies

Bottom Line

Paying off your mortgage with rental sale proceeds is not a purely financial decision. The math matters, but flexibility matters just as much. Eliminating a mortgage lowers fixed expenses, reduces pressure on your portfolio, and can make retirement income more sustainable during market downturns.

Keeping the mortgage can work when rates are low, cash flow is strong, and the proceeds stay invested with discipline. The right choice is the one that supports steady decisions, lower stress, and long term sustainability not just the highest projected return

Should I Pay Off My Mortgage With Rental Sale Proceeds FAQs

Should I pay off my mortgage with rental sale proceeds

It depends on your mortgage rate, tax impact, retirement timeline, and how much flexibility you want during market downturns.

Does paying off my mortgage help in retirement

Yes. Eliminating a mortgage lowers required monthly income and reduces pressure on investment withdrawals.

Is it better to invest rental sale proceeds instead of paying off my mortgage

Investing may offer higher returns, but it adds risk and requires discipline during market volatility.

What taxes apply when selling a rental property

Capital gains tax, depreciation recapture, and selling costs can significantly reduce net proceeds.

Can paying off my mortgage improve portfolio longevity

Lower fixed expenses can support lower withdrawal rates, helping portfolios last longer.

Reference

Internal Revenue Service. (n.d.). Property basis and sale of home. Retrieved from https://www.irs.gov/faqs/capital-gains-losses-and-sale-of-home/property-basis-sale-of-home-etc/property-basis-sale-of-home-etc-3

Rocket Mortgage. (n.d.). When to sell a rental property. Retrieved from https://www.rocketmortgage.com/learn/when-to-sell-rental-property

Investopedia. (n.d.). What is the optimal down payment. Retrieved from https://www.investopedia.com/what-is-the-optimal-downpayment-11774040

Bankrate. (n.d.). The psychological perks of paying off debt. Retrieved from https://www.bankrate.com/personal-finance/debt/psychological-perks-of-debt-payoff

HomeLight. (n.d.). Selling a rental property to pay off a primary residence. Retrieved from https://www.homelight.com/blog/selling-rental-property-to-pay-off-primary-residence/