What Are the 7 Steps Raytheon Retirees Can Take to Reduce Unnecessary Taxes?

Raytheon retirees often save well and contribute heavily to their 401(k). The surprise comes later, when taxes take a larger bite than expected. Not because of bad decisions, but because retirement income follows different rules.

Taxes show up through required distributions, Social Security, Medicare premiums, and poorly timed withdrawals. This article breaks down 7 practical steps Raytheon retirees can use to protect retirement savings from unnecessary taxes.

1. Understand Where Your Tax Risk Really Comes From

Most Raytheon retirees built the bulk of their savings in traditional tax deferred accounts. That includes a 401(k) and rollovers into traditional IRAs. These accounts helped reduce taxes during working years. They also create future tax exposure.

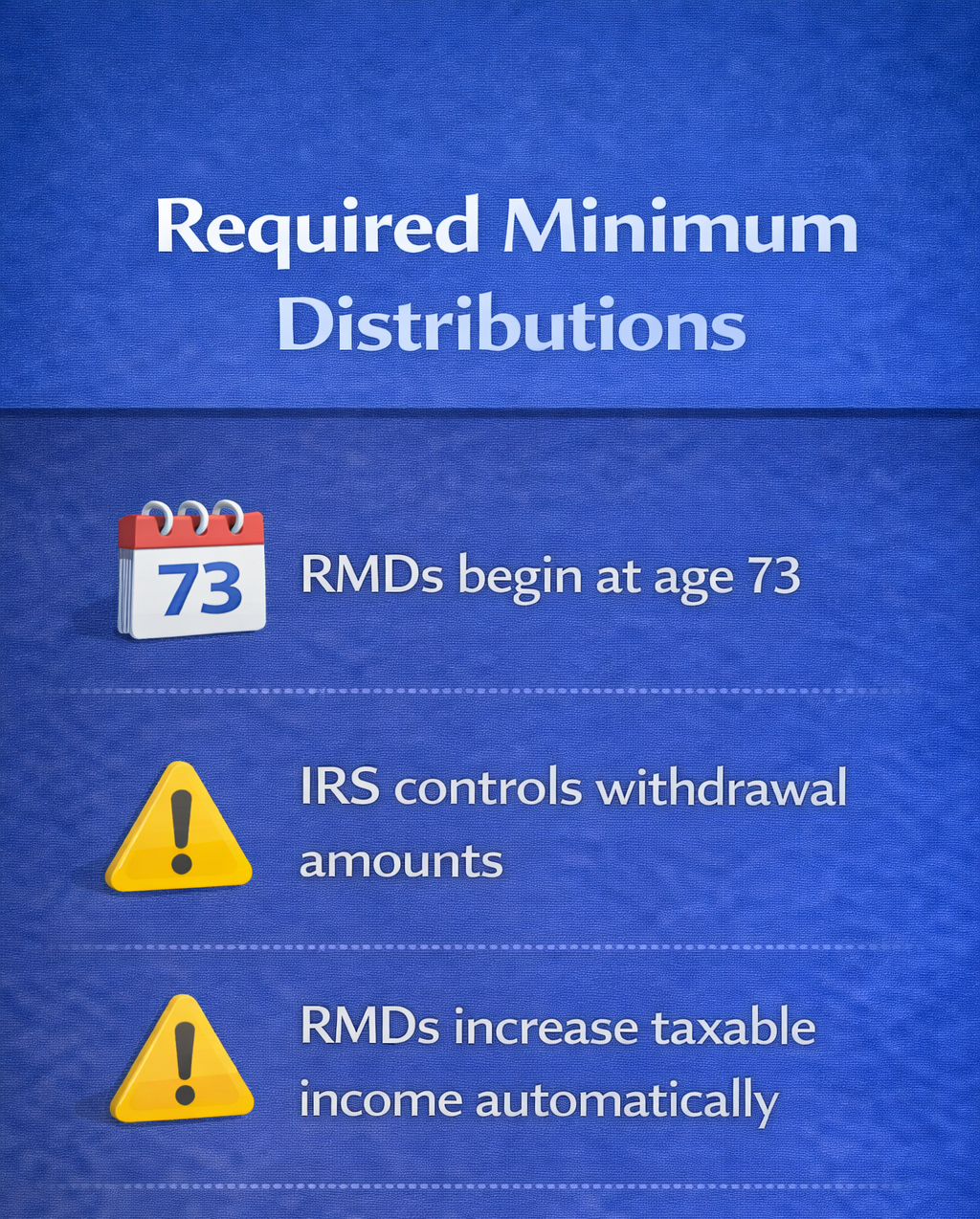

Once required minimum distributions begin, the IRS dictates how much you must withdraw each year. Those withdrawals count as ordinary income. They stack on top of Social Security and any other income sources.

The issue is not the tax rate alone. The issue is control. Large required withdrawals can push income higher than expected and trigger taxes in places many retirees do not anticipate.

Download Raytheon Tax-Smart Retirement Planning Playbook

2. Plan for Required Minimum Distributions Before They Start

Required minimum distributions begin at age 73. At that point, you no longer choose how much taxable income you report from traditional retirement accounts.

Many Raytheon retirees wait until RMDs start to think about taxes. That timing limits flexibility. The most effective planning happens earlier, during the years after full time work ends and before required withdrawals begin.

Using those lower income years to rebalance accounts can reduce the size of future RMDs. Smaller required withdrawals often lead to lower lifetime taxes and more predictable income.

3. Use Roth Conversions Carefully and Gradually

Roth conversions allow you to move money from tax deferred accounts into Roth accounts. You pay tax on the conversion today. Future growth and withdrawals can remain tax free if rules are met.

The key is pacing. Large conversions in a single year can spike income and create new tax problems. Many Raytheon retirees benefit from spreading conversions across multiple years.

This approach can help fill lower tax brackets intentionally instead of being pushed into higher ones later. It also reduces the size of future required distributions, which gives you more control over taxable income in your seventies and beyond.

4. Pay Attention to Social Security Taxation

Social Security often feels tax free. In reality, up to 85% of benefits can become taxable depending on total income.

Provisional income includes other taxable withdrawals and even some tax exempt interest. That means the way you pull money from retirement accounts affects how much of your Social Security gets taxed.

Strategic withdrawals can help manage this exposure. Pulling from Roth accounts does not increase provisional income. Poor coordination between account types can quietly turn Social Security into a larger tax burden than expected.

5. Withdrawal Strategies Must Be Individualized to Minimize Taxes

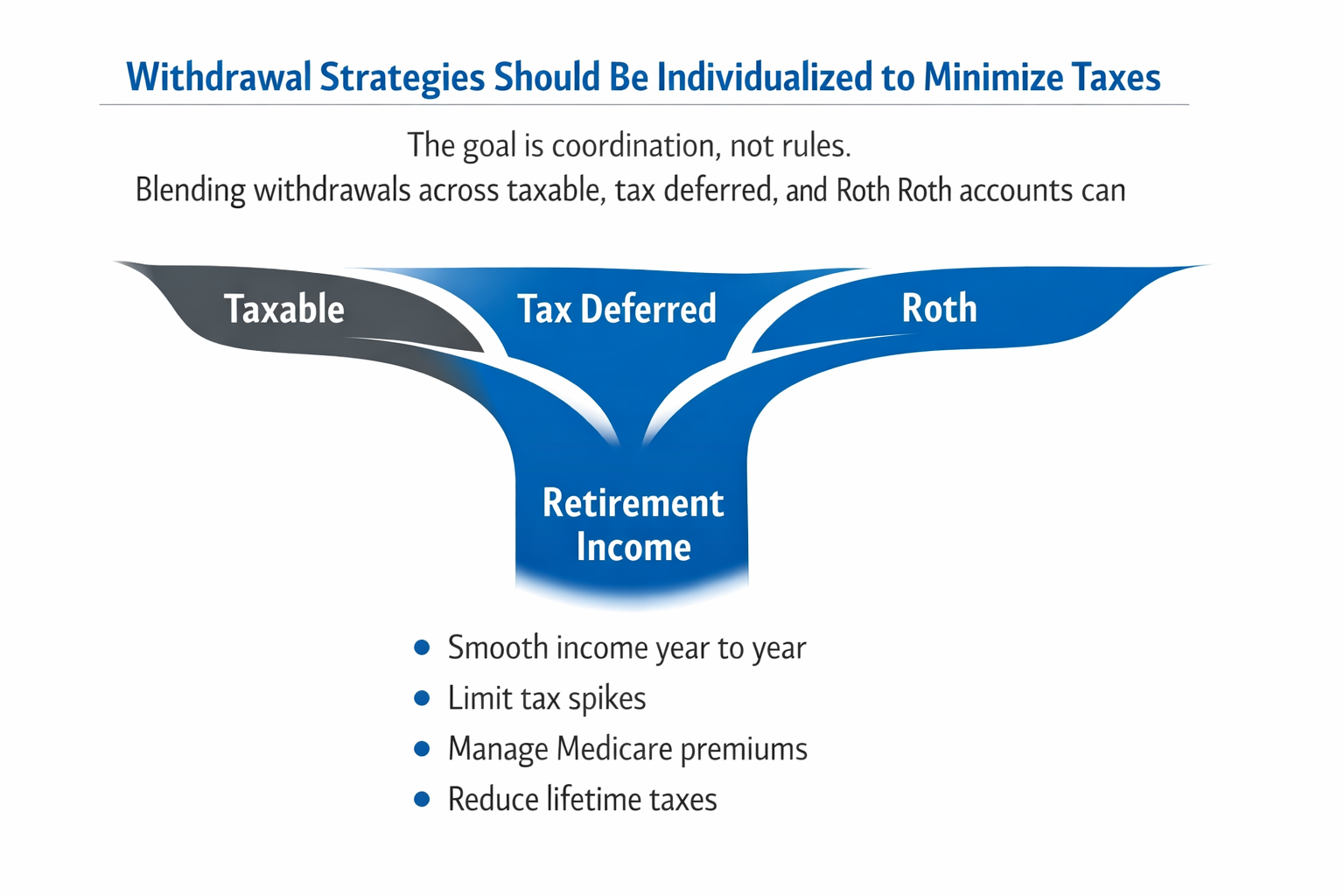

Many retirees hear a simple rule. Spend taxable assets first. Then tax deferred. Then Roth. In practice, this sequence often works, especially in early retirement, because it can reduce current taxes while creating room for Roth conversions before required minimum distributions begin.

But no withdrawal order fits every client. Income sources, tax brackets, portfolio mix, and timing all matter. In some cases, blending withdrawals from tax deferred or Roth accounts alongside taxable assets can prevent uneven tax years and avoid future income spikes.

The goal is not a fixed rule. It is coordinated withdrawals across taxable, tax deferred, and Roth accounts to minimize lifetime taxes. Done well, this approach helps smooth income, manage Social Security taxation, and control Medicare premium thresholds year to year.

6. Watch Medicare Premium Thresholds

Medicare premiums increase when income crosses certain levels. These surcharges are known as income related monthly adjustment amounts.

What surprises many Raytheon retirees is that one year of higher income can raise premiums for future years. A single large withdrawal or Roth conversion can trigger higher costs even after income drops again.

This does not mean you avoid planning moves. It means you coordinate them. Understanding how withdrawals affect both taxes and healthcare costs helps avoid unnecessary penalties.

Download Raytheon Tax-Smart Retirement Planning Playbook

7. Revisit Your Plan as Rules and Income Change

Retirement tax planning is not a one time decision. Tax rules change. Income sources shift. Spending patterns evolve.

Raytheon retirees often carry multiple income streams including pensions, Social Security, and investment withdrawals. Each piece affects the others.

Reviewing your withdrawal strategy regularly helps keep taxes aligned with your goals. Small adjustments made early often prevent larger problems later.

How ONE Advisory Partners Supports Raytheon Retirees

Jeffrey Davis AAMS® helps Raytheon retirees make sense of RMDs, Social Security timing, and withdrawal decisions so taxes do not quietly undermine retirement income. He focuses on how each decision affects the full picture, not just one account or one year.

Jeff reviews income needs, account structure, and investment strategy together. He helps you compare options, understand the tax impact, and build a clear plan for steady retirement income. To get guidance tailored to your situation, schedule a conversation with Jeffrey Davis AAMS®, Wealth Advisor at ONE Advisory Partners, serving clients nationwide.

Download Raytheon Tax-Smart Retirement Planning Playbook

Bottom Line

Taxes may feel unavoidable in retirement, but overpaying is not. Most tax issues come from timing and structure rather than bad decisions.

Raytheon retirees who understand where taxes come from and plan ahead gain flexibility. They reduce surprises. They protect more of what they worked decades to build.

The goal is not to eliminate taxes. The goal is to keep them predictable, manageable, and aligned with your life, not dictated by default rules.

FAQ for Raytheon Retirees

Do Raytheon retirees pay taxes on Social Security?

Yes, many do. Up to 85% of Social Security benefits can be taxable depending on your total income. Withdrawals from traditional retirement accounts often trigger this without retirees realizing it.

When do required minimum distributions start for Raytheon retirees?

Required minimum distributions start at age 73 for most retirees. These withdrawals are mandatory and count as ordinary income, which can increase taxes and affect Medicare premiums.

Can Roth conversions help Raytheon retirees lower lifetime taxes?

They can. Converting portions of tax deferred savings to Roth accounts before RMDs begin may reduce future taxable income. Timing and pacing matter to avoid unnecessary tax spikes.

Do Roth accounts affect Social Security taxation?

No. Qualified withdrawals from Roth accounts do not count toward provisional income. This can help reduce how much of your Social Security becomes taxable.

Why do some Raytheon retirees face higher Medicare premiums?

Medicare premiums rise when income crosses specific thresholds. Large withdrawals or conversions in one year can increase premiums later, even if income drops afterward.

Is it better to withdraw from one account at a time in retirement?

Not always. While spending taxable accounts first can work, coordinating withdrawals across taxable, tax deferred, and Roth accounts often helps smooth income and reduce lifetime taxes based on your specific situation.

Should Raytheon retirees review their tax strategy every year?

Yes. Tax rules change and income sources shift. Regular reviews help keep taxes aligned with your retirement goals and avoid surprises.

Reference

Social Security Administration. (n.d.). Your Retirement Benefits Retrieved from https://www.ssa.gov/pubs/EN-05-10024.pdf

Investopedia. (n.d.). Roth 401(k) Definition Retrieved from https://www.investopedia.com/terms/r/roth401k.asp

Charles Schwab. (n.d.). Why Consider a Roth IRA Conversion and How to Do It Retrieved from https://www.schwab.com/learn/story/why-consider-roth-ira-conversion-and-how-to-do-it

Fidelity. (n.d.). Tax Savvy Withdrawals Retrieved from https://www.fidelity.com/viewpoints/retirement/tax-savvy-withdrawals#:~:text=Finding%20the%20right%20withdrawal%20strategy,higher%20lifetime%20after%2Dtax%20income.

Bankrate. (n.d.). Reduce Taxes in Retirement Retrieved from https://www.bankrate.com/retirement/reduce-taxes-in-retirement/