Should You Keep the House After Divorce?

Divorce forces decisions you never expected to make on your own, and few feel heavier than deciding what to do with the family home. Keeping the house often feels like the safe and responsible choice, especially when children, routines, and familiar surroundings are involved.

Should you keep the house after divorce? Before you commit, it is important to look beyond emotion and understand how this decision affects your cash flow, liquidity, taxes, and long term financial stability on one income.

The Single Income Reality

A home that worked on two incomes can quickly overwhelm one. Mortgage payments do not shrink after divorce, and property taxes, insurance, utilities, maintenance, and repairs all fall on one person. When housing costs push past about thirty percent of income, cash flow stress builds fast.

Maintenance is often underestimated. Budgeting roughly two percent of the home’s value each year is realistic, but many homeowners cannot absorb those costs alone. When housing takes up too much of your budget, savings pause, retirement contributions stop, and emergency reserves shrink right when stability matters most.

Download Financial Life After a Life Transition

The Illusion of Equity

Home equity feels like wealth, but it is not the same as cash. Keeping the house usually means buying out your former spouse and refinancing the mortgage into your name alone. Qualifying on one income can be difficult, and if refinancing fails, both names may remain on the loan, creating ongoing joint liability.

Even when refinancing works, equity stays locked in the property. It cannot easily fund emergencies, career changes, education costs, or retirement income. This is how many divorced homeowners end up owning a valuable home while feeling financially stretched.

The Opportunity Cost You Do Not See

Every dollar tied up in home equity is a dollar not working elsewhere. When a large share of your net worth sits in one property, you limit diversification and flexibility and take on more risk than you may realize.

If you buy out your spouse and later need to sell, transaction costs can quietly erase value. Agent fees, repairs, staging, and closing costs often consume six to ten percent of the sale price. That lost capital could have funded retirement savings, emergency reserves, or a more flexible lifestyle.

Tax Traps After Divorce

Taxes rarely drive emotional decisions, but they often punish them. Married couples may exclude up to five hundred thousand dollars of capital gains when selling a primary residence. After divorce, that exclusion typically drops to two hundred fifty thousand dollars for a single filer.

If you keep the home and sell later, you may face a tax bill that could have been avoided by selling earlier. Buying out your spouse also transfers their cost basis to you, increasing future tax exposure. Mortgage interest and property tax deductions may help, but they rarely offset a large capital gains tax hit.

Download Financial Life After a Life Transition

Emotional Weight Cuts Both Ways

Keeping the home can feel comforting, especially when children stay in familiar rooms, schools, and routines. On the surface, life may seem less disrupted during an already difficult transition.

At the same time, a home can carry emotional baggage and ongoing financial stress. Living in a house that strains your budget creates anxiety children often sense. In many cases, a smaller and more affordable home provides more stability than a familiar one that creates constant pressure.

Renting and Downsizing Are Strategic Not Failures

Selling does not mean giving up. In many cases, it means regaining control. Renting or downsizing can free up cash, lower expenses, and create breathing room during a major transition.

Many people choose to rent after divorce even if they could buy. Flexibility matters. Renting allows you to reassess location, lifestyle, and long term goals without locking into another large asset before you are ready.

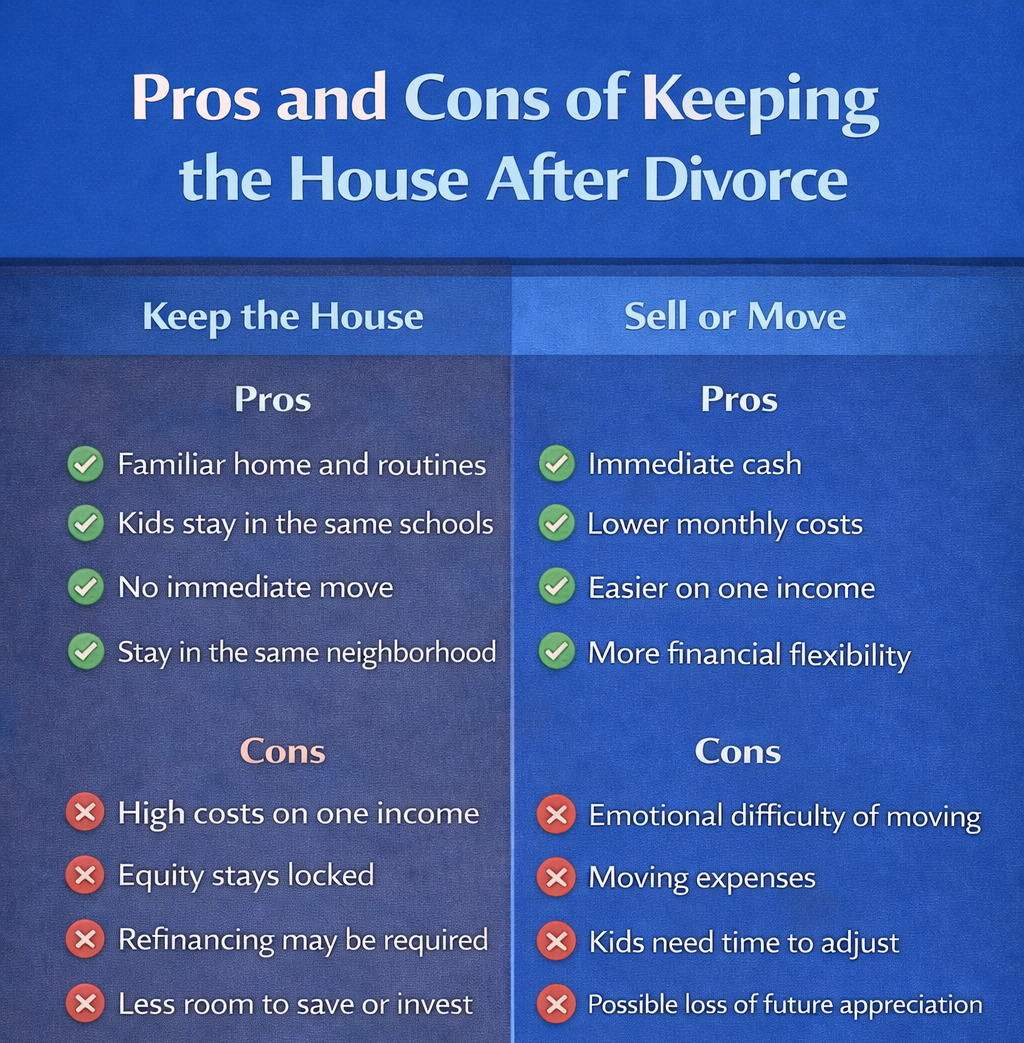

Pros and Cons of Keeping the House After Divorce

Keeping the family home can feel like the safest option, but it comes with clear financial tradeoffs. Here is a simple side by side look at the pros and cons to help you decide what fits your situation.

The Better Question to Ask

The question is not can you keep the house. The real question is should you. Can you afford it on one income while still saving and investing. Can you handle repairs without draining reserves? Can you refinance cleanly and absorb future tax consequences?

If the answer feels uncertain, pause. Selling the house is not a failure. Stability comes from cash flow, flexibility, and the ability to move forward without constant financial pressure, not from a specific address.

How ONE Advisory Partners Helps

At ONE Advisory Partners, divorce planning focuses on helping you make clear financial decisions during a complex transition. The work goes beyond asset division. It connects housing choices, cash flow, taxes, investments, and long term planning so your decisions support financial stability on one income.

You work with Christel Turkiewicz, CRPC®, CDFA®, a Wealth Advisor with over 30 years of experience in wealth management and financial education. Christel specializes in divorce financial planning, retirement planning, tax strategy, and life transitions, guiding clients with both technical expertise and empathy as they rebuild financial confidence and move forward.

If you are navigating financial decisions after divorce, a conversation can help bring clarity. Schedule a time with Christel Turkiewicz to talk through your options and next steps.

Bottom Line

Keeping the house only makes sense if it fits your post divorce income, preserves flexibility, and supports long term financial stability. If it limits cash flow, savings, or options, selling or downsizing may be the more responsible move.

Frequently Asked Questions About Keeping the House After Divorce

Should I keep the house after divorce

Only if you can afford it comfortably on one income while still saving, investing, and covering unexpected repairs without stress.

Is it better to sell the house during or after divorce

Selling during divorce may preserve larger capital gains tax exclusions and simplify the financial split, but timing depends on your specific situation.

Why does home equity matter after divorce

Equity tied up in a home cannot easily be used for cash flow, emergencies, or retirement, which limits financial flexibility during transition.

Will I need to refinance if I keep the house

In most cases yes. Refinancing removes your former spouse from the mortgage and shifts full responsibility to you.

Does keeping the house help children adjust

Stability matters, but children often adapt well to a new home when financial stress is lower and the household feels calmer.

Reference

Fidelity Canada. (2025). Should you keep the family home after divorce? Fidelity Canada. Retrieved from https://www.fidelity.ca/en/insights/articles/keep-family-home-after-divorce/

First American Blog. (n.d.). Shecession Can’t Slow Homeownership Surge Among Single Women. First American. Retrieved from https://blog.firstam.com/economics/she-cession-cant-slow-homeownership-surge-among-single-women

Locus, H. (2023). Four Things To Consider When Deciding Should I Keep the House in Divorce. Forbes. Retrieved from https://www.forbes.com/sites/heatherlocus/2023/04/13/four-things-to-consider-when-deciding-should-i-keep-the-house-in-divorce/

Internal Revenue Service. (n.d.). Filing Taxes After Divorce or Separation. IRS. Retrieved from https://www.irs.gov/individuals/filing-taxes-after-divorce-or-separation#:~:text=If%20your%20agreement%20was%20signed

Charles Schwab. (n.d.). Tax Implications of Divorce. Schwab. Retrieved from https://www.schwab.com/learn/story/tax-implications-divorce